On April 24, 2024, Members of the European Parliament officially adopted the proposal for the Corporate Sustainability Due Diligence Directive. The EU’s landmark sustainability directive will now enter a period of national adoption, as member states will be given two years to integrate the new legislation into their individual law books.

The Directive takes a unique approach as it aims to raise the level of sustainable practices throughout Europe without necessarily creating regulatory burdens on companies that may not have the requisite resources. As a result, businesses will need to start preparing now, as companies throughout Europe will be impacted by the directive, whether they’re technically in scope or not.

The Corporate Sustainability Due Diligence Directive proposal has gone through several iterations, with the EU making major changes at the end of 2023, and finally passing it through the Council of the European Union in March 2024. While some argue that the final proposal significantly watered down the strength of the directive, the EU ultimately passed legislation that should, in theory, help big and small businesses alike prioritize sustainability without going bankrupt.

The increasingly complex compliance landscape

The EU compliance landscape has steadily grown in complexity as individual countries and the European Union itself attempts to solve for the rising risks inherent in global value networks. Companies must consider ongoing issues including climate change, social conditions, and geopolitical situations, all of which can impact their supply chains and their bottom lines.

The German Supply Chain Due Diligence Act, the U.S. Uyghur Forced Labor Protection Act, and the EU Corporate Sustainability Reporting Directive are some key examples of legislations that were passed in the past few years that can affect companies worldwide. Each new regulation that passes differs slightly in aim, scope, and requirements, creating a very tricky compliance burden.

Though large, multinational businesses are likely to fall under the scope of several regulations, they are most likely to have the resources to handle various regulatory demands. However, small- and medium-sized businesses are finding the sudden increase in due diligence and reporting requirements difficult to execute successfully.

The EU is pushing forward with its aim to be carbon neutral by 2050, enacting a series of laws known as the EU’s Green Deal. However, after consultation with business and industry leaders, the EU is working to pass legislation that supports businesses in reaching sustainable practices, instead of imposing further regulatory burdens that may stifle SMEs.

The Corporate Sustainability Due Diligence Directive proposal

In the Corporate Sustainability Due Diligence Directive’s proposal, the EU emphasized the idea of taking “appropriate action” for sustainability issues within a value network. “Appropriate action” is broadly defined as supporting suppliers struggling with sustainability compliance. Instead of punishing smaller businesses outright for failing to meet compliance standards, the Corporate Sustainability Due Diligence Directive instructs the larger companies within scope to help, so all companies can benefit from more sustainable practices.

The EU’s most powerful companies, plus global companies that have significant operations within the EU, will be on the hook for delivering a sustainable business future for all. The Directive suggests financial means or in-kind aid that companies at the top can give their resource-poor suppliers, including loans or training. To this end, businesses within scope must have a very clear understanding of their entire value networks, and keep an eye out for any emerging risks that could impact their suppliers. They must then use their influence and power to help their suppliers mitigate these risks and take steps to prevent them in the future.

Once the directive is adopted, EU member countries will have two years to transpose the law into their individual legal systems. Then, the legislation will be phased in over another period of two years, reaching full scope in 2029.

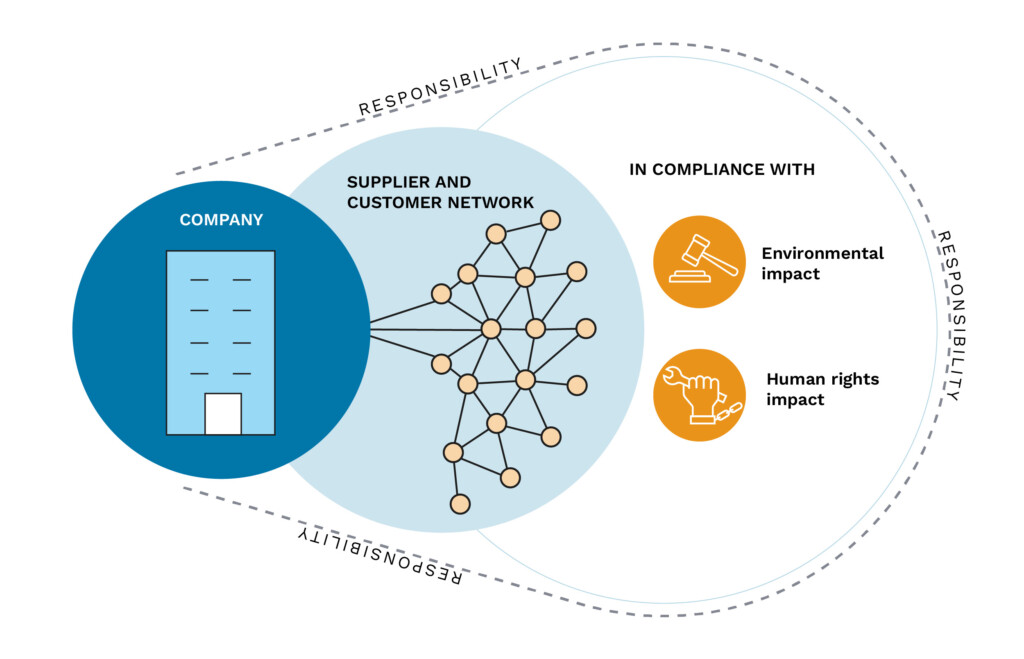

Figure 1: The Corporate Sustainability Due Diligence Directive proposal was designed to shift compliance responsibilities from agencies to corporations.

Figure 1: The Corporate Sustainability Due Diligence Directive proposal was designed to shift compliance responsibilities from agencies to corporations.

Scope of the Corporate Sustainability Due Diligence Directive proposal

The EU purposefully focused on the largest companies operating within the bloc, and even watered down the qualifications of scope while the Corporate Sustainability Due Diligence Directive was in the proposal phase.

As a result, companies within the scope of the Corporate Sustainability Due Diligence Directive are:

- EU companies with over 1000 employees and a net turnover of more than €450 million worldwide

- Parent companies with over 1000 employees and a net turnover of more than €450 million

- Non-EU (third country) companies with over 1000 employees and a net turnover of more than €450 million

- Franchises with a net turnover of over €80 million, if at least €22.5 million of that turnover was generated through royalties

The original proposal had slightly different rules around scope, including a much lower financial bar to include companies within the scope of the Corporate Sustainability Due Diligence Directive. However, after negotiations within the proposal phase, the EU refocused their targeted range of companies to ensure that only the largest and most powerful companies within the EU were tasked with maintaining compliance to the directive.

Preparing for the new sustainability landscape

Though the largest companies may be the only ones in scope of the directive, all companies should start preparing now to implement more sustainable practices. Businesses within scope will have the responsibility of monitoring and mitigating sustainability risk factors throughout their supply chainsv, using whatever resources they have at their disposal. Contracts with suppliers must now include sustainability requirements, so suppliers will have to make sure to heed those, lest they risk losing a major contract or coming under significant scrutiny and pressure.

Meanwhile, large companies must start aligning their business practices and goals with sustainability measures, such as carbon neutrality goals. Creating and implementing these updated practices has to start now – four years is not a long time to change established processes within large, often multinational organizations.

All companies, no matter their size, must get a proper grip on their value networks. Using advanced technology to map and visualize a supply network, coupled with AI-powered analytics to determine and highlight key risks, gives companies the best chance of understanding the extent of their networks’ reach around the world. Armed with this information, companies can make effective, informed decisions about their processes, suppliers, and compliance maintenance.

The EU is hoping that a rising tide of sustainability will lift all companies. With the passage of the Corporate Sustainability Due Diligence Directive proposal, the largest companies will be compelled to take an active interest in the sustainability practices of their value networks, supporting them even in difficult times. No more cutting bad suppliers and running—companies must now work within the business community to create a more sustainable environment for all.