From the reverberating effects of the Ukraine war to intensifying climate conditions to disruptions caused by the COVID-19 pandemic, several factors are disrupting production and shipping continuity in global fashion supply chains. Here are the biggest supply chain challenges the retail industry faces today.

Eyes on compliance

Customers, executives, and shareholders are all watching retailers closely for human rights and environmental violations. Negative media coverage on these issues can deeply damage operations, profits, and share prices.

The Uyghur Forced Labor Prevention Act (UFLPA) went into effect on June 21, 2022, but it’s just one of many global regulations affecting the retail industry. Procurement and planning leaders now need a deeper level of supplier risk analysis for compliance and social governance issues like child and forced labor.

Rising energy costs

Energy prices across Europe have recently reached all-time highs as ongoing disruptions to energy supply and a scorching summer spiked prices across the region. Fiber making, textile dyeing, and textile finishing are all energy-intensive processes, and an increasing number of manufacturers in Europe have temporarily curtailed or even halted production.

The energy crisis threatens to intensify even further during winter, and a growing number of companies may be forced to temporarily stop production or even cease operations in the region due to unsustainable production costs.

More strikes and labor unrest

Manufacturers in the apparel industry, which has traditionally paid comparatively low wages in Southeast-Asian countries including Bangladesh, Pakistan, and India, have been particularly affected by wage increase demands in recent months. Companies find themselves confronted with large wage increase demands that correspond to rising food and energy price level surges.

Retailers will face more industrial action if inflation remains a major concern for workers.

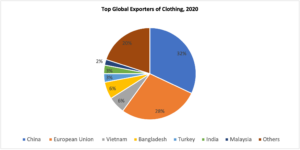

Continued pandemic shutdowns

Although vaccinations are widespread, severe pandemic disruptions still emerge regularly in China as the Chinese government continues to adhere to a strict zero-COVID policy. Approximately 87% of large export-oriented garment, textile, and footwear factories are concentrated in the provinces of Guangdong, Zhejiang, Fujian, Jiangsu, and Shandong. Any fresh COVID-19 related restrictions in these five coastal provinces could disrupt global textile supply chains and manufacturing.

Raw materials shortages

Extreme weather threatens the price outlook for cotton, one of the most important natural fibers in textiles due to its rapid growth rate and wide range of apparel applications. India and Pakistan have recently been plagued by heavy rains and pests, forcing authorities to import cotton supplies.

Cotton prices have been rocked by extreme heat in major cotton-exporting countries. In the United States cotton output is estimated to be the worst in a decade due to prolonged drought in Texas, which accounts for almost half of the U.S. cotton output. The U.S. is the top cotton exporter globally, followed by Brazil, where droughts have cut yields by an estimated 30%. China’s recent heatwave could impact the upcoming cotton harvest, adding to price and supply woes for the fashion industry’s key raw material.

Mitigating these retail challenges

Retail brands must develop real-time visibility into extended supplier networks, gaining a clearer understanding of the full supply chain from raw material production and harvest to packaging and product distribution. In some cases, companies may need to fundamentally rearrange their networks to adjust for production disruptions, scarce components/inputs, and delayed shipping timetables.

Download our eBook to learn how best-in-class retailers are leading with technology