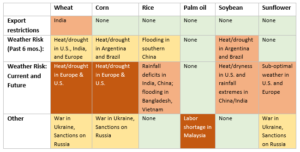

A July 22 agreement between Russia and Ukraine to unblock grain exports from major Black Sea ports came as a major relief to global grains and vegetable oils supply concerns, with the Food and Agricultural Organization (FAO) Food Price Index plunging almost 9% in July; its biggest decline since 2008. Corn prices are still 70% higher than February 2020, and wheat prices 60% higher than pre-pandemic levels.

On August 13, the first grain shipment from Ukraine since the onset of port blockades arrived at the port of Ravenna in Italy, carrying 13,000 tons of corn. Following this success, three subsequent vessels bound for Ireland, the U.K., and Turkey departed Ukrainian ports, transporting a combined 58,000 tons of corn. Despite this positive development, it is expected that most of this cargo is bound for use as animal feed and will not yet contribute to food shortage alleviation, the worst of which are hitting developing countries. Ukraine claims that roughly 20 million tons of grains remain stuck in silos and at ports, six million tons of which is wheat. Of that, only three million tons of wheat is expected to be allocated for human consumption. In any case, this gradual export resumption signals a move toward trade normalization which is expected to increase global grain supply and further stabilize prices.