Sunflower

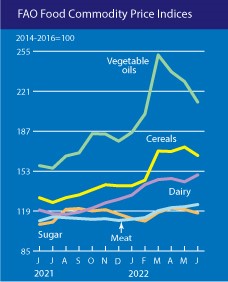

Russia, to avoid domestic shortages and ease domestic prices, introduced an export quota on sunflower oil and an outright ban on sunflower seeds in March. However, in citing sufficient domestic supply on July 17, Russian authorities decided to increase the export quota for sunflower oil and meal by 400,000 tons and 150,000 tons, respectively. Sunflower oil exports are now capped at 1.9 million tons, and sunflower meal exports are capped at 850,000 tons until August 31. In just one month, the landed cost of crude sunflower oil declined by 14% to $1,750 per ton from $2,050 per ton in June.

Soybean

Soybean exports in Argentina faced disruption in June when a nationwide trucker strike blocked exports from the Port of Rosario, the country’s most critical agricultural port. The strike lasted eight days, from June 22 to 30, during which Rosario terminals received 76% fewer loaded grain trucks than the same time last year. Argentina is the world’s top exporter of processed soybean oil and meal and 80% of grains bound for export move by ground freight. As a result, the strike amplified impacts. Following the end of the strike, port operations immediately resumed, and grain exports normalized. From June to July 2022, the landed cost of crude soybean oil declined by 24% to $1,400 per ton from $1,845 per ton.

Palm oil

Indonesia has raised its palm oil export quotas and removed export levies on palm oil products amid high domestic inventories. Meanwhile in Malaysia, daily losses of palm oil fruit are estimated at 57,880 tons due to an acute shortage of plantation labor. Recent estimates show that the palm oil industry in Malaysia is still 120,000 workers short of what is needed to reach and maintain desired production levels. Despite the production challenges in Malaysia, the stockpile of palm oil fruit in Indonesia is expected to lead to a 20% decrease in palm oil market price by September. From June to July 2022 alone, global prices of crude palm oil decreased from $1,735 per ton to $1,150 per ton. As Indonesia moves into its next harvest season and domestic reserves increase, the market will likely further shrink.

Wheat

Efforts to reach an agreement to unblock Ukraine’s Black Sea ports and resume grain exports are underway. Authorities expect negotiations to conclude in agreement by July 22, with the global wheat market beginning to normalize shortly thereafter. To advance this goal, Romania has reopened a Soviet-era rail link connecting its Danube River port of Galati to Ukraine one month earlier than expected. While this is expected to help boost vital grain exports from Ukraine, it is too early to measure success. Ukrainian officials have reported that the country will be forced to halt further wheat harvests if solutions are not reached, as storage silos have exceeded capacity. Farmers have reportedly already threshed 3.6 million tons of grain from about 10% of the sowing area of Ukraine’s 2022 harvest.

Meanwhile, continued dryness in some regions of Argentina have cut wheat planting and impacted estimates for the 2022-2023 harvest from 18.5 million tons to 17.7 million tons. However, Brazil is expected to make up some of Argentina’s losses, with 2022-2023 wheat harvest estimates totaling 9 million tons. These estimates come after Brazilian farmers sowed the largest area of wheat crop in the past 32 years, at 7.1 million planted acres. Due in part to the promise of Ukraine’s grain ports being unblocked and to the optimism of Brazil’s wheat harvest, the market is recovering from a five-month low.

Rice

The fear of an export ban on rice in India was stoked by a delay in sowing due to an irregular start to the summer monsoon rainy season. Because of this, traders began placing orders for longer-dated deliveries in anticipation of impending restrictions. Bangladesh also began importing rice from India much earlier in the year than what is considered typical and cut import duties on rice from 62.5 to 25%. Production success will be dependent on the reliability and consistency of monsoon rains for the remainder of the growing season. Consecutive flooding events in southern China in late June and early July also contributed to disruptions in rice production, during which approximately 100,000 hectares of rice crops were damaged. China continues to experience extreme weather events such as flash flooding and extreme heat, increasing the likelihood of future disruptions to rice production.

Sugar

On May 24, authorities in India announced a cap of 10 million tons of sugar exports for the current marketing year running through September. By the end of June, raw sugar stockpiles in ports and warehouses reached 500,000 tons. At the plea of struggling sugar mills with limited storage capacity, authorities have since permitted sugar exports of one million tons. Previously, the deadline for export shipments was set for July 5. However, monsoon rains have complicated transport logistics from sugar mills to ports, prompting authorities to extend the grace period to July 20. In the next two months, authorities will decide if an export cap on sugar will be implemented for the 2022-2023 season which begins in October. The speculated cap is between 7-8 million tons.

Key developments to monitor this summer

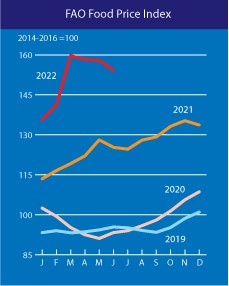

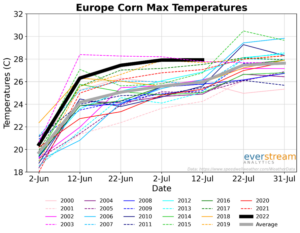

Near-term weather conditions into August in key agricultural production zones will determine whether the global food crisis will improve or further deteriorate. Increased risks of heat waves and dryness in the U.S. and Europe make for a dour outlook.

Concurrent risks from flash flooding in parts of China and inconsistent monsoon patterns in India add to the possibility of crop failure and inadequate yields. At the same time, the ongoing war in Ukraine will continue to impact grain exports until an agreement can be reached to unblock shipments.

Sporadic bouts of unrest that lead to logistics disruptions, such as the truckers’ protest in Argentina, add to the uncertainty around food supply and price stabilization. Thus, though some commodities such as edible oils and wheat have the promise of near-term normalization, overall risks to global food supply will remain for several months to come.

Everstream customers are receiving detailed information about this disruption.

Contact us to learn how we can give you a complete view of the risks affecting your end-to-end supply chain and what you can do to mitigate them.