Your chief financial officer has a tough job.

But a major part of their success depends on the performance of the chief supply chain officer. The CSCO worries about the whole supply chain and its many moving parts. Demand planning and forecast accuracy, supply planning, buffer stock levels, inventory management, logistics, freight costs, and on-time-in-full (OTIF) performance to name a few.

And sure, let’s not forget about the chief procurement officer. That’s no easy task either. The CPO, along with teams of procurement professionals, and category or commodity managers, can oversee many, many thousands of suppliers across different parts of the world. If inbound goods do not arrive in time, production can grind to a halt – and, since you can’t sell what you can’t make – revenue is at risk.

Given how deeply the CFO’s success is intertwined with the operational excellence of both the CSCO and CPO, this interdependence makes a case for examining the specific value drivers that effective supply chain risk management (SCRM) brings to the table.

Most CFOs only see the cost of supply chain risk management – not the value of the risks that were avoided, and therefore, they never had to pay for.

Much of that value, particularly in quantifying avoided risk, has historically gone unseen or unmeasured. That is changing. Today, the path to capturing and demonstrating it is clearer than ever, allowing leaders to move beyond abstract concepts and focus on tangible business outcomes.

Seen and Unseen Supply Chain Risk

Your supply chain is at the core of your business operations, from the flow of raw materials and parts into your manufacturing facilities to the final delivery to your customers.

Potential threats loom at every step of this journey, from supplier bankruptcies to trade restrictions, port congestion, as well as extreme weather or natural disasters.

Some of these threats are tangible, and it is easy to see when you have successfully managed to navigate them. Others are much harder to quantify. Sometimes the biggest value of supply chain risk management is invisible. You cannot see, for instance, the factory shutdown that never happened, because you avoided risk, or the revenue loss that would have occurred because of it.

Defining Supply Chain Risk Management

No supply chain is completely free of risk. But that does not mean that you should shrug your shoulders and call it the cost of doing business.

The Association of Supply Chain Management (ASCM) defines supply chain risk management as the “identification, assessment, and mitigation of potential supply chain disruptions” with the goal of minimizing the impacts of supply chain risk on overall supply chain performance.

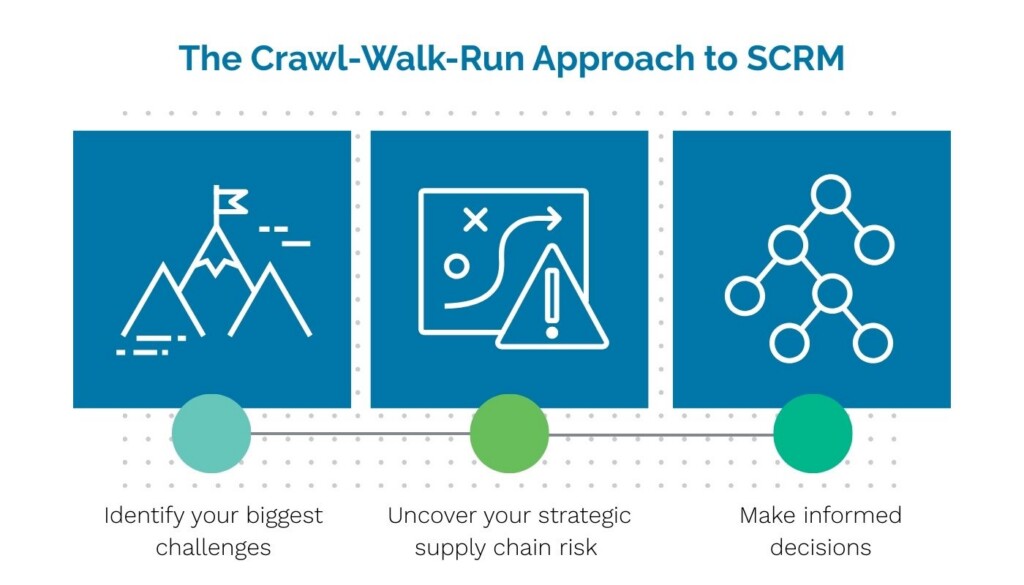

Figure 1: The ASCM recommends a three-stage approach to supply chain risk management

As the ASCM notes, there are three phases in supply chain risk management:

- Identifying supply chain risks to know where you’re exposed.

- Mitigating the impact of potential threats

- Monitoring the supply chain to ensure the threat has been effectively addressed

For years, the conversation around supply chain risk focused on building resilience through redundancy. Adding more buffer stock, or dual sourcing goods may protect production schedules, but at a cost – excess safety stock ties up working capital. Redundancy is expensive.

Unfortunately, the opposite is also true: doing nothing is expensive.

If you have no strategy in place to deal with supply chain risk, you are at the mercy of an unforgiving market. Disruptive events can trigger expensive firefighting. Expedited freight charges pile up. Lost revenue from stockouts mounts.

In either scenario, you are likely to have an uncomfortable conversation with your CFO.

In simple terms, SCRM is about knowing what could go wrong, understanding what it would cost you, and acting before it does.