A confluence of global crises resulted in a turbulent year for industrial metals in 2022. Prices of several industrial metals soared to unprecedented heights last year amid a volatile market environment. Industrial metals will remain susceptible to sudden supply and demand changes during the first half of 2023 as underlying reasons for the disruptions are unlikely to disappear.

Click here to download the full PDF report with detailed data about each metal

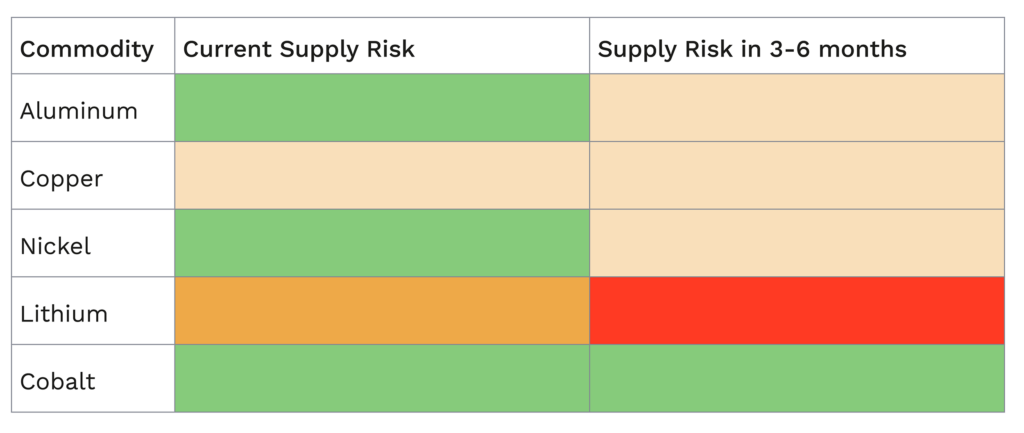

This white paper focuses on key industrial metals commonly used in a wide range of manufacturing industries including automotive aerospace, consumer electronics, and household goods. Our analysis of aluminum, copper, nickel, lithium, and cobalt includes key market developments, last year’s biggest market disruptors, and what potential risk factors supply chain managers should watch for in the next three to six months.

Turbulence in 2022 for metal supply chain

The past year was uncommonly turbulent for global industrial metal markets. Russia’s February invasion of Ukraine sent shock waves through the world’s supply chains, raising prices of many industrial metals to record-breaking heights. Then a confluence of other global crises left many industrial metals susceptible to supply and demand shifts throughout the year.

The persistent zero-COVID policy in China hampered mining, refining, and manufacturing for copper, cobalt, and lithium. As fears of a global recession grew during the latter part of 2022, demand for aluminum and other high-use metals dropped while political and worker protests drove down supply and demand for nickel and other key industrial metals.

Figure 1: Supply and demand risk for selected industrial metals (source: Everstream Analytics). Green = low risk; light orange = medium risk; dark orange = medium-high risk; red = high risk

Aluminum outlook

Aluminum prices were volatile in 2022 due to the Russia-Ukraine war and shifting global energy prices. The metal peaked at $3,849/ton on the London Metal Exchange (LME) in March 2022. However, prices have since declined by as much as 40% due to lingering uncertainties about recession and China’s post-pandemic economic recovery. The price of aluminum is currently trading at about $2,200/ton.

Aluminum is the most energy-intensive base metal to produce, and soaring energy costs following Russia’s Ukraine invasion caused Norsk Hydro, Aluminum Dunkerque, and Alcoa to suspend operations entirely. In Europe, production cuts resulted in a drop of around 1.4 million tons of aluminum capacity. In America, production cuts led to a drop of around 300,000 tons of aluminum, with production halts reported at Century Aluminum’s Hawesville plant and Alcoa’s Warrick smelter.

In China, a prolonged drought impacted energy generation in the hydro-dependent provinces of Yunnan, Sichuan, and Guizhou. In Guizhou, authorities ordered a third round of load shedding, impacting production at Zunyi Aluminum, Chinalco Guizhou, and Guizhou Huaren, and cutting their output by 50%. Aluminum smelters in Yunnan province were ordered to cut capacity by as much as 20% in mid-September. Production will remain curtailed until May 2023 when hydro-reservoir levels are expected to stabilize. In Sichuan, aluminum smelters were forced to halt production entirely in August amid a sweltering heatwave, taking offline 2% of China’s total aluminum production for two weeks.

Supply and demand expectations

Despite production cuts in Europe and China, ample aluminum supplies and weaker demand will continue to push the market into surplus. That surplus is expected to reach about 800,000 tons of aluminum in 2023.

Key issues that will affect the expected surplus:

Indonesia’s bauxite ban in mid-2023. Indonesia will impose a ban on bauxite exports from mid-2023. Indonesia holds the fifth-biggest bauxite reserves and is the sixth-largest producer of the commodity, which is a prerequisite ore used to make aluminum. Though an exact suspension date has not been confirmed, the announcement sent aluminum prices rising on the LME.

High energy prices. Soaring energy costs following Russia’s Ukraine invasion remain a threat. Despite the recent energy price decrease, it is unlikely that Europe’s aluminum smelters will come back online during winter and the ongoing Ukraine war. Further smelter closures and curtailments in production cannot be ruled out given the highly volatile nature of energy prices heading into 2023.

Potential ban on Russian aluminum. Uncertainty lingers about potential western sanctions on Russian aluminum. Both the U.S. and the LME are weighing new sanction packages on Russian metals. Though an outright ban seems unlikely, the U.S. is considering raising import tariffs on Russian aluminum or imposing sanctions on Russia’s largest aluminum producer, Rusal. Similarly, the LME may impose caps on Russian metal in its warehouses.

Copper outlook

Chile and Peru, which together produce almost 40% of the world’s copper, saw political and worker protests impact copper production in 2022. Chile’s copper output lowered 6.7% year-on-year in the first half of 2022. Peru’s production growth was only 1.4% over the same period.

One of the world’s top copper mines, Las Bambas in Peru, which accounts for about 1.4% of the world’s production has had recurring issues with blockades and demonstrations in 2022. Protesters and security clashed in April 2022. Social unrest in Peru also led to blocked roads and railways at various times in 2022, most recently in December, disrupting mining operations and transport.

Mining in Chile faced similar issues. In October 2022, copper transport on trains was suspended in northern Chile due to repeated thefts, while in November, an indefinite strike by truckers prevented the transit of supplies to sites in the mining regions of the north.

The price of copper has fallen by nearly a third since March 2022, when the price hit an all-time high at above $10,000/ton on the LME amid an industrial metal price surge following Russia’s invasion of Ukraine. Since then, increased energy costs and recession fears have caused a continued price decline, reaching a low of $7,000 in July before recovering in recent months.

China, the world’s largest copper importer, has been a key market driver. When China implemented strict COVID lockdown measures, copper prices fell in the second quarter of 2022. Declines in China‘s real estate values, U.S. interest-rate hikes, and slowing global economic growth influenced copper demand as well.

Supply and demand expectations

Global copper demand is expected to rise by 2% in 2023, while copper mine production is predicted to rise by around 4%. However, global copper stockpiles will enter 2023 nearly depleted. Inventories can currently cover approximately five days of global consumption. In the coming months, the copper market will be susceptible to sudden demand or supply changes.

Key factors include:

Unrest in South America. With 28% of global copper production occurring in Chile and 10% in Peru, social and political unrest will be decisive to copper production. Peru’s protests in late 2022 caused a nationwide crisis lasting well into 2023 and threaten to cut access to almost 2% of global output, while Chile could see clashes renew over drafting a new constitution.

Economic outlook. A hard landing for the U.S. economy would likely drive down copper demand which dropped significantly during prior recessions. Conversely, copper demand could increase through 2023 if China’s economic recovery continues, with the country consuming half of the world’s copper.

Energy transition. The ongoing green energy transition, and growing demand for electric vehicles, will likely push copper demand as well. Solar panels and wind turbines have some of the highest copper content of all renewable energy technologies. The production of electric vehicles requires four times more copper than the making of conventional fossil fuel-based combustion engine vehicles.

Nickel outlook

Nickel market turbulence in 2022 included an unprecedented trading halt on the LME when prices reached a staggering $100,000/ton. Prices climbed by as much as 15% in November after reports of a smelter fire at an Indonesian plant owned by CNGR Advanced Material Co. Since then, prices have stabilized. Nickel is now trading at around $29,000/ton, but still notably higher than trades in 2021.

On March 8, 2022, the nickel market was rocked by a short squeeze sending prices to a peak of $100,000/ton. Rumors about sanctions on Russian nickel and the shorting position held by China’s Tsingshan Holding Group drove prices to quadruple within 12 days. The squeeze caused an unprecedented eight-day trading halt on the LME and all transactions that took place on March 7 were rescinded.

In December, a fire at IGO Limited’s Nova mine (accounting for 30% of its annual nickel production) forced the company to halt operations for 20 days. A fire in Monchergorsk also caused substantial damages to the production hall area for low-grade nickel products operated by Norilsk Nickel, PJSC, one of the world’s largest nickel producers. Meanwhile, another major mining company, Glencore plc, faced a strike action at its Raglan mine in Canada from the end of May until early September, severely disrupting operations at the site.

Supply and demand expectations

In 2023, the nickel market is expected to remain in surplus. Global production is expected to reach up to 3.45 metric tons in 2023, whereas global demand is expected to come in at about 3.34 metric tons. This will result in an expected overall surplus of about 110,000 tons of nickel in the upcoming year.

This surplus will depend on these factors:

Tighter supply. The Government of Indonesia plans to appeal a ruling by the World Trade Organization (WTO) that prohibited it from suspending nickel ore exports. Officials may also levy increased taxes on nickel products and have floated the idea of a nickel cartel similar to that of OPEC. In Australia, government officials are working on a critical minerals strategy that would limit processed nickel exports on the grounds of national security interest. Canadian authorities prohibited further Chinese investment in its nickel industry due to national interests.

Geopolitical disputes. Russia’s war in Ukraine poses a significant risk to the nickel market as EU leaders consider a total ban of Russian nickel on the LME. A ban would eliminate approximately 11% of the world’s supply of nickel from the marketplace. Norilsk Nickel warned that European buyers are already shunning Russian supplies even without sanctions, a trend that may continue as the war drags on.

The U.S. Inflation Reduction Act. The Inflation Reduction Act (IRA) aims to increase domestic production of critical minerals in the U.S. Increased domestic production would reduce dependence on China for nickel refinement and would allow the U.S. to develop a localized supply chain for electric vehicles, solar panels, renewable power production infrastructure, and other green technologies. However, the plan has been greeted with backlash from close allies including France and Germany, who warned that the act breaches international trade rules and threatens European businesses.

Lithium outlook

Lithium prices have surged by 123% year-to-date, with prices for lithium carbonate hitting an all-time high of ¥599,000/ton ($88,303/ton) in November 2022.

Lithium prices remained high in 2022. Electric vehicle demand rose while supply was limited, and lithium miners were unable to scale supply rapidly enough to keep up. After a brief dip in demand due to lockdowns in China, where various vehicle manufacturing plants shut down, the lithium market shifted upwards, with demand returning through the second half of 2022.

China accounts for over 80% of the world’s lithium refining capabilities, and operational disruptions there disturbed the lithium market in 2022. In August, record temperatures created a two-week power crisis in Sichuan Province, prompting production halts and limiting lithium output. Authorities ordered lithium refiners in Yichun City, Heilongjiang Province, to suspend operations amid an investigation into pollution of a local river in December 2022. That city produces more than a quarter of China’s total lithium carbonate, and manufacturing operations will remain halted until the investigation is over.

In the same month, Zimbabwe, the world’s sixth largest producer of lithium, imposed an export ban on unprocessed lithium. Foreign companies must now build local lithium processing plants; however, those currently building processing plants will reportedly be excluded from the directive.

Supply and demand expectations

With lithium demand high, mining companies announced restart and expansion plans, including increasing production at several sites in Chile and Australia. These new mining projects should begin production in 2023. A potential drop in demand from manufacturers, particularly in China, where the government ended EV and hybrid subsidies at the end of 2022, the supply deficit may lessen by the second half of 2023. However, some estimates point to a structural shortage until 2025 amid continued lithium market volatility.

Supply and demand will depend on several risk factors:

Geopolitical disputes. China controls over 80% of the world’s lithium refining and processing capacity, and accounts for large portions of global lithium-ion battery production. This dependency will leave global lithium supply chains vulnerable to trade tensions between China and several western countries. Those tensions are expected to intensify further in 2023.

New mining projects. Lithium supply will significantly increase as several new mines begin operations and existing ones are expanded in Canada, Mexico, Australia, and Chile. However, regulatory, technical, and commercial challenges may prolong the supply expansion process. Delays could keep the lithium market tight amid doubts about the ability of less established producers to deliver expected lithium volumes.

Environmental concerns. Citizens and governments worldwide express growing concerns over lithium mining’s environmental impact. In China, officials will likely continue to crack down on pollution during winter, potentially shutting down even more lithium-related production sites in the coming months. Protests over high water usage during lithium extraction have been taking place at mines in Argentina and Chile for years and may re-erupt on short notice as social tensions continue to simmer in South America.

Cobalt outlook

After reaching a high point at almost $40/pound in late April, cobalt prices fell significantly throughout the rest of 2022. Prices generally stabilized during the summer, but by early December cobalt futures fell to their lowest levels since July 2021, standing at $21.07/pound at the Chicago Mercantile Exchange (CME).

Driven by growing fears of a global recession, consumer demand for many electronic goods decreased in 2022. Rising inflation levels reduced consumer spending power in many countries, further curbing electronic goods demand during the second half of 2022. Demand for cobalt, used in manufacturing cell phones, tablets, and laptop computers, saw a corresponding decline.

Higher energy costs dampened demand from energy-intensive industries including ceramics and chemicals. Overall manufacturing costs in these sectors spiked, particularly in Europe, following Russia’s invasion of Ukraine.

During the year, China’s zero-COVID resulted in widespread snap lockdowns, severely disrupting manufacturing operations in the country that refines around 70% of global cobalt supply yearly.

Supply and demand expectations

A combination of strong production and weak demand is expected to push the cobalt market into surplus. While global production is forecast to increase to 206.000 tons, demand across the world is estimated to only grow to 194.000 tons in 2023, predicting a surplus of more than 10.000 tons of cobalt next year.

Key factors include:

Weak consumer demand. With the current economic climate expected to remain fragile throughout winter season, consumer spending will likely remain low for electronics and electric vehicles well into the first months of 2023.

Geopolitical disputes. No direct sanctions have been imposed yet on cobalt exports from Russia (the world’s second biggest producer after the Democratic Republic of the Congo). But sanctions against Russian products or companies, including large cobalt producer Norilsk Nickel, remain on the table as western governments try to curb Russia’s ability to finance its war in Ukraine.

Legal disputes. Cobalt exports from the Tenke Fungurume Mine accounted for 10% of global cobalt output in 2021. Those exports were suspended in July due to a royalty payment dispute between CMOC Group Limited, a Chinese molybdenum producer, and Gécamines, the biggest mining company in the Congo. As the Chinese firm considers legal action to lift the ban, it remains unclear when the flow of cobalt from the world’s second-largest cobalt mine will resume.

Metal supply chain outlook and recommendations

Several of the industrial metals covered in this analysis will likely remain susceptible to sudden supply and demand changes throughout the first three to six months of 2023. Some of the underlying crises, including the war in Ukraine, geopolitical tensions, and a looming global recession, will continue well into the year and may even worsen as the year progresses.

Considering the wide-ranging disruption impacts to the industrial metals supply, customers are advised to keep abreast of the latest developments regarding mining, refining, and manufacturing operations linked to the metals most pertinent to their global supply chains.

By leveraging the Everstream’s Reveal solution companies can monitor early signs of potential operational disruptions to mines and processing facilities across the world, giving supply chain managers the ability to adjust procurement and logistics strategies before full-scale deterioration.

In the long-term, Everstream’s Discover solution enables companies can gain deeper insight into their extended supplier networks. This provides visibility into operational risks before they become unmitigated emergencies. Even in the most complex supply chains, Discover can support companies in identifying and adjusting to the challenges of sourcing affected raw materials or components from affected facilities.

Learn more about how the Everstream platform can help your operation identify, monitor, and avoid metal supply chain risks.

Download the full white paper with detailed data and pricing charts for each metal