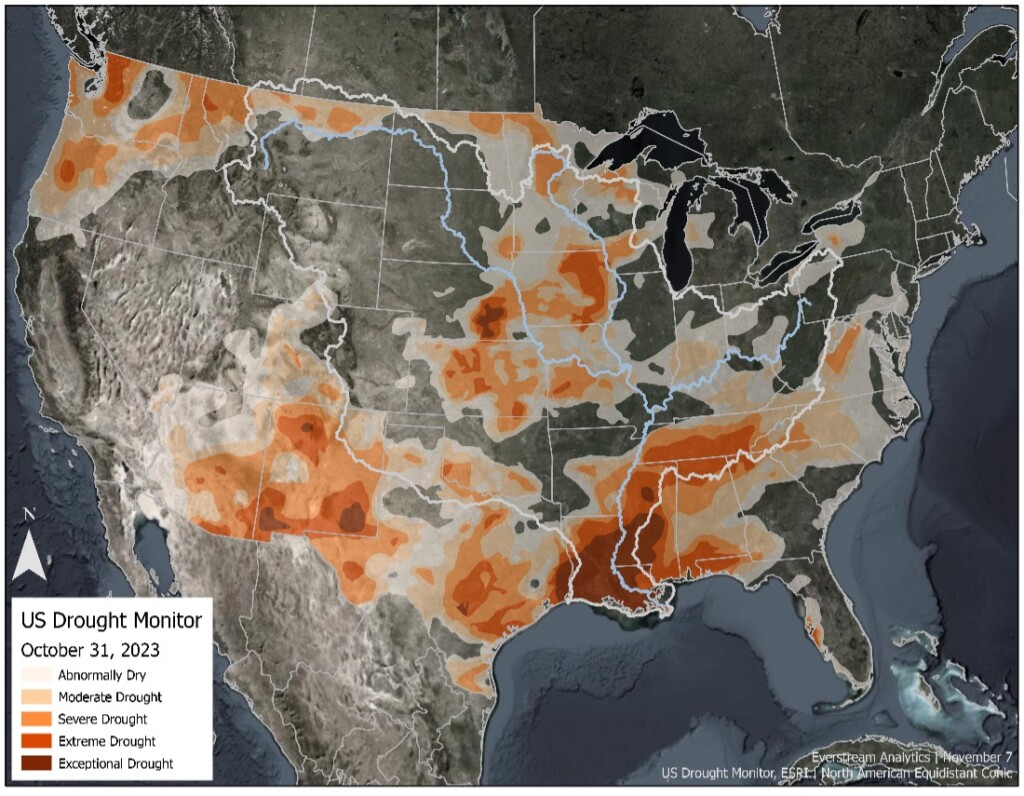

Further waiting times are expected along the Pacific and Atlantic entrances of the canal with bulk carriers, freighters, and tankers bearing the brunt. Very Large Tanker Carriers (VLTC) have begun to avoid the canal and opt for alternate routes through the Suez Canal due to increased waiting times, a trend that is likely to continue into 2024. Other shipping operators will also consider rerouting cargo via the Suez Canal or round the Cape of Good Hope in order to ensure that product will arrive on time at the customer’s intended destination.

Improvement to the drought situation in Panama is unlikely to occur in the short to medium term. Focus will now be shifted to the country’s next wet season which starts in May 2024 and how rapidly the situation would improve.

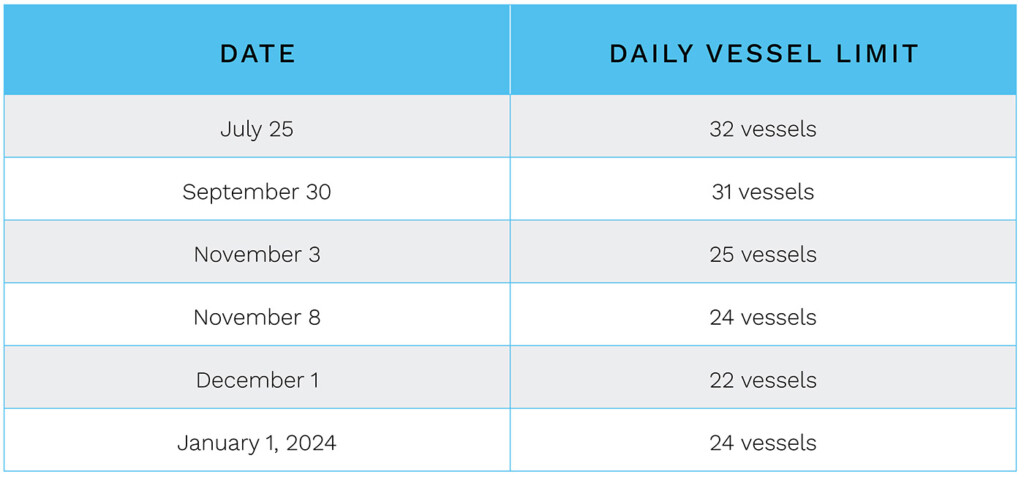

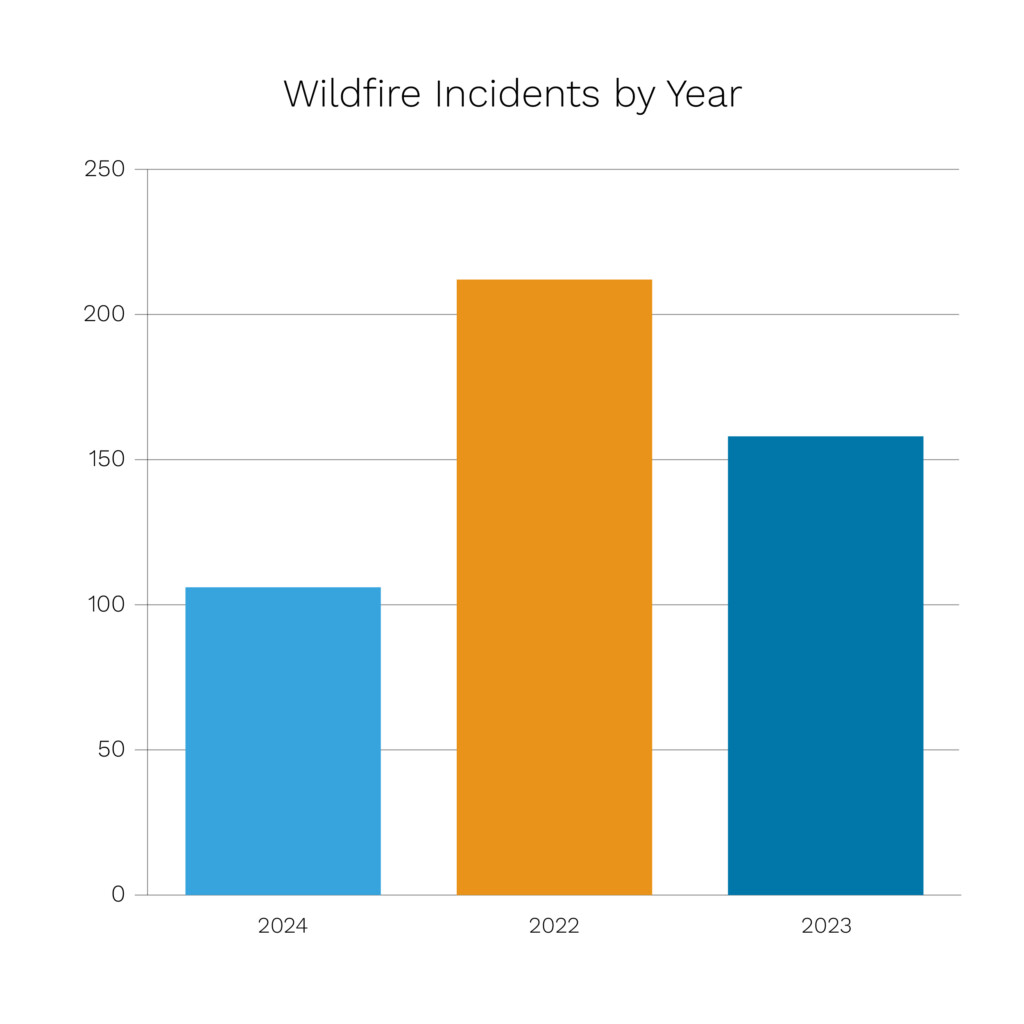

Figure 1: U.S. drought conditions will continue to affect commodity production areas (source: Everstream Analytics).

U.S. logistics disruptions increase

In the U.S., major gauges along the Mississippi River have been sitting at record low levels this autumn with the gauge at Memphis, Tennessee reaching the all-time record low of -12.04 feet (3.67 meters) on October 17th. Farther upriver, water levels at the New Madrid, Missouri gauge have been sitting just above the five feet (1.52 meter) operating level. While river levels normally rise and fall through the year, with water levels reaching their seasonal low in the fall and winter, the river has reached its low far earlier than normal. The root cause of these low levels has been the combination of above normal temperatures and below normal rainfall in the Mississippi River Basin.

As in 2022, continued drought conditions in the Mississippi River Basin present a significant threat to cargo transportation in 2024 throughout the river system. Shallow conditions along the river will reduce barge weight capacity. Vessels will be forced to carry less cargo to clear sandbars. Should river levels fall further, all barge transportation could be suspended.

Transportation along the Mississippi River is vital to the United States agriculture sector, with 92% of the nation’s agricultural exports traveling along the river. The U.S. lacks both the rail and road infrastructure to fully absorb a major cargo disruption along the river. River levels are likely to improve during the winter months (starting in December) due to increased precipitation via the El Niño events in the equatorial Pacific. El Niño winters in the Mississippi Basin tend to feature abundant precipitation which will improve the situation.

Wildfires to disrupt logistics in 2024

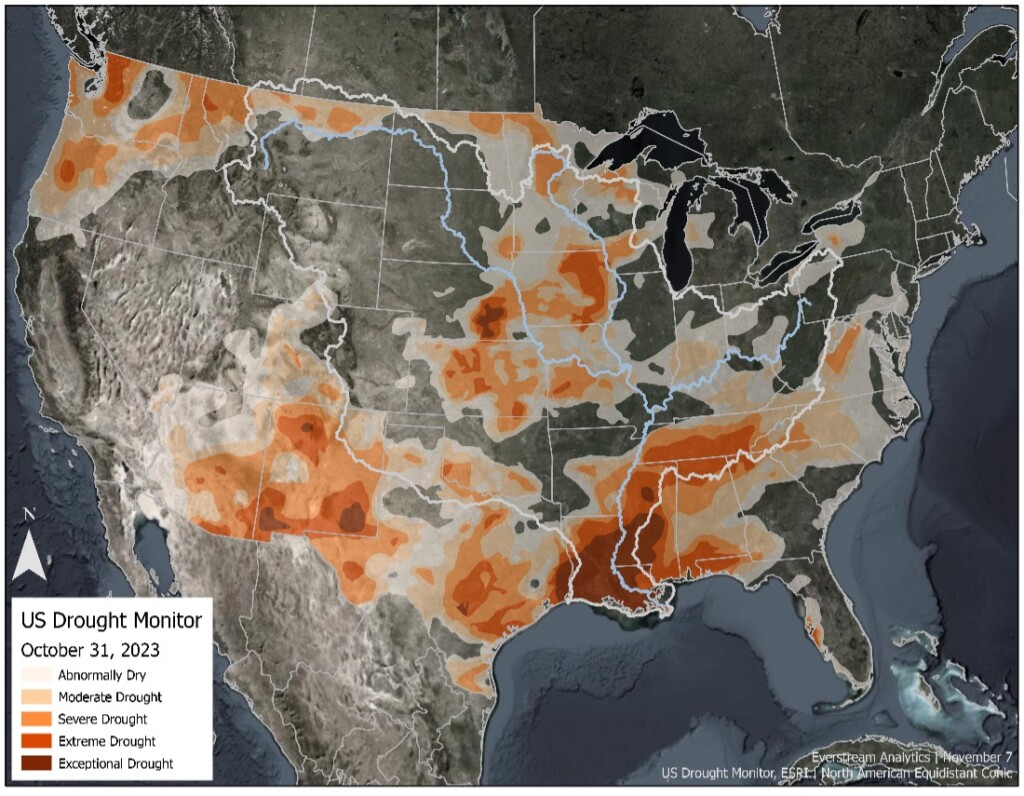

Wildfires continue to pose a threat to manufacturers and logistics operators, with Everstream Analytics tracking more than 143 wildfires with supply chain implications in 2023. Canada and Greece experienced one of the worst wildfire seasons in recent history. In Greece, the country battled more than 82 wildfires due to soaring temperatures primarily in the northern, western, and central regions from July to September. Wildfires damaged industrial zones in Aspropirgos and Volos destroying at least five warehouses and two factories.

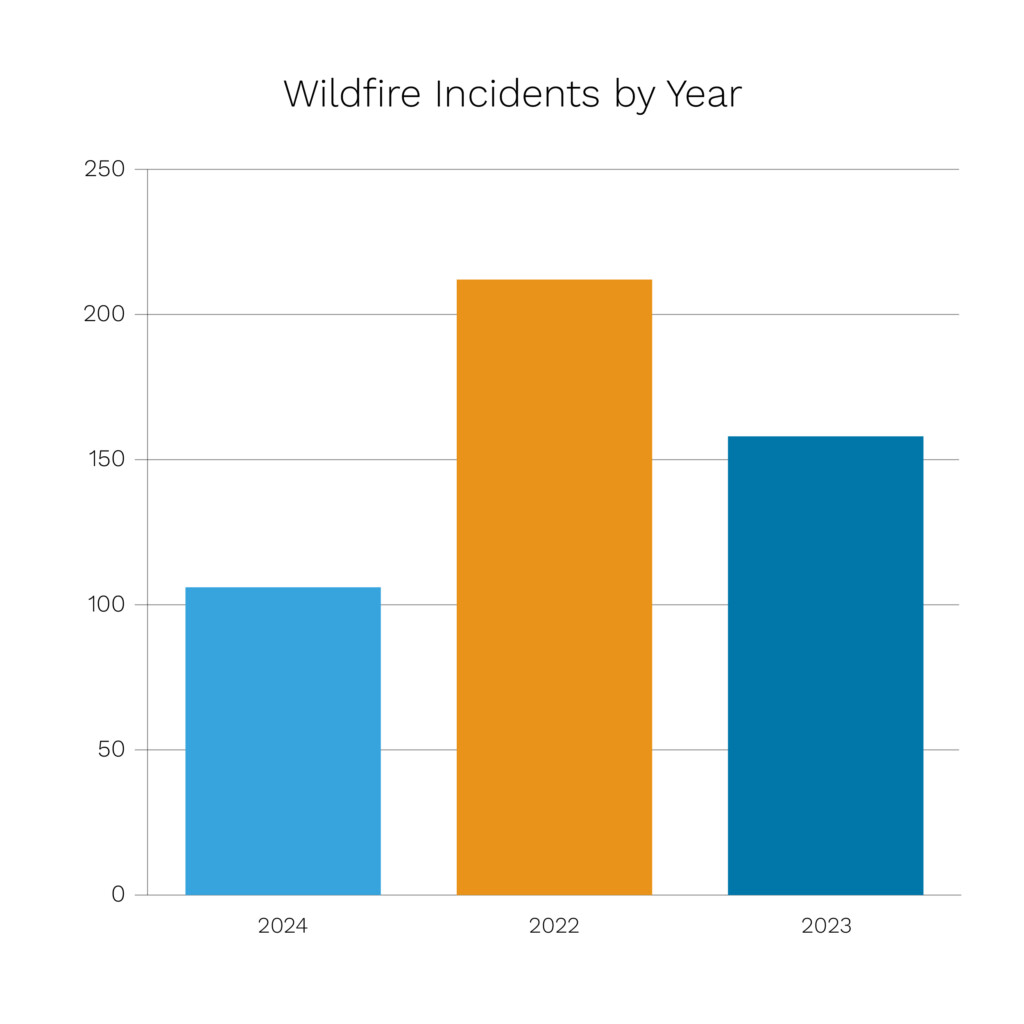

Figure 2: Number of wildfire incidents tracked by Everstream Analytics annually since 2021 (source: Everstream Analytics) 2023 figures to be updated closer to publication date

In Athens, smog caused by the wildfires forced several factories to halt operations due to health concerns. In total, the Greek economy sustained $1.9 billion (€1.8 billion) in financial damages due to wildfires.

The 2023 U.S. wildfire season was significantly lower than 10-year averages for recorded fires and total acreage burned. Canada recorded its worst wildfire season in the country’s history with more than 45.7 million acres of land burned, far surpassing the previous high of 17.5 million acres set in 1983. All 13 provinces and territories were affected, with British Columbia, Alberta, Quebec, and Nova Scotia being particularly impacted.

Wildfires caused disruptions to Canada’s mining, energy, and packaging sectors and companies including Cenovus Energy Inc, Paramount Resources Ltd, Winsome Resources, and Resolute Forest Products. Furthermore, smog from these wildfires caused disruptions to aviation and road traffic in both Canada and the United States.

With El Niño weather conditions beginning 2024, the threat of wildfires is expected to increase in parts of South America, Southeast Asia, and in Australia. Australia is in the midst of its wildfire season which has started early due to soaring temperatures in spring. Currently there are about 100 active wildfires across Queensland, New South Wales, Western Australia, and the Northern Territories. Though damages and disruptions remain limited thus far, weather forecasts suggest that deteriorations are expected. Wildfires could disrupt the country’s agricultural and mining sectors.

In Indonesia, growing wildfires risk are expected to cause disruptions to the country’s palm oil and agricultural industries. Furthermore, toxic wildfire smog could impact the wider Southeast Asia region with countries such as Malaysia, Brunei, and Singapore potentially impacted.

Clearly, extreme weather events are growing in number and severity around the globe. The more the planet warms, the greater the impacts on logistics, people, businesses, and the supply chain overall.