Consumers are shifting preferences and often opting for more environmentally conscious businesses, leading many companies to work on self-motivated environmental, social and governance (ESG) strategies. However, even the most forward-looking companies are likely to be impacted by growing environmental regulations that aim to introduce environmental protections more quickly.

From 1972 to 2019, there was a 38x increase in environmental laws, including the European Union’s Corporate Sustainability Due Diligence Directive (CS3D), and this figure continues to quickly multiply as countries rush to meet looming net-zero emissions goals and protect ever-scarce natural resources.

In addition to regulations mandating controls on carbon emissions, new mandates including those that tackle the usage of distinct substances like ethylene oxide and per- and polyfluoroalkyl substances (PFAS), deforestation-linked inputs, and single-use packaging are set to increase costs and disrupt supply chains across all industries in 2024.

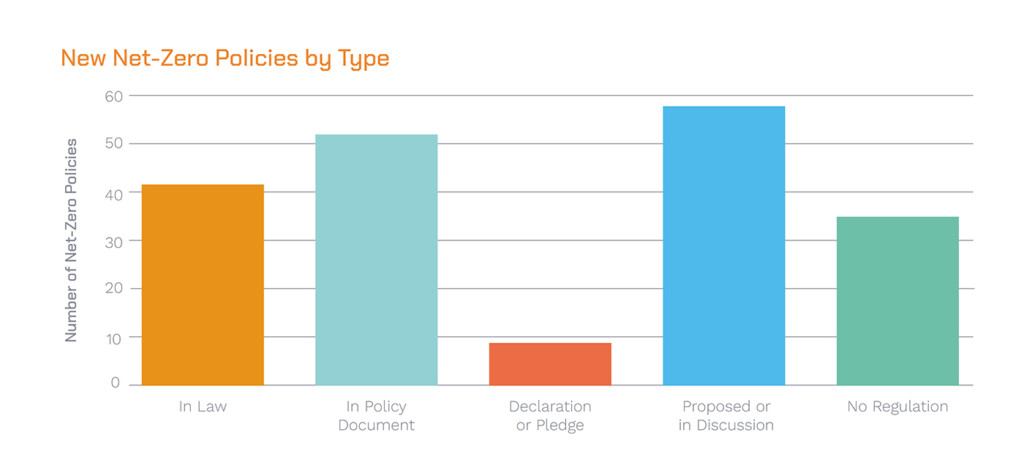

Figure 1: Total countries with net-zero commitments (source: Energy & Climate Intelligence Unit (2023).

Figure 1: Total countries with net-zero commitments (source: Energy & Climate Intelligence Unit (2023).

Global ESG supply chain management emphasis growing

A growing number of countries have adopted or are in the process of adopting net-zero or other ESG-related climate policies. While good for the planet, with most of these targets coming to a head in 2050 and interim targets set for 2030, businesses may face disruptions or raised prices as they are forced to adopt production practices to further these goals.

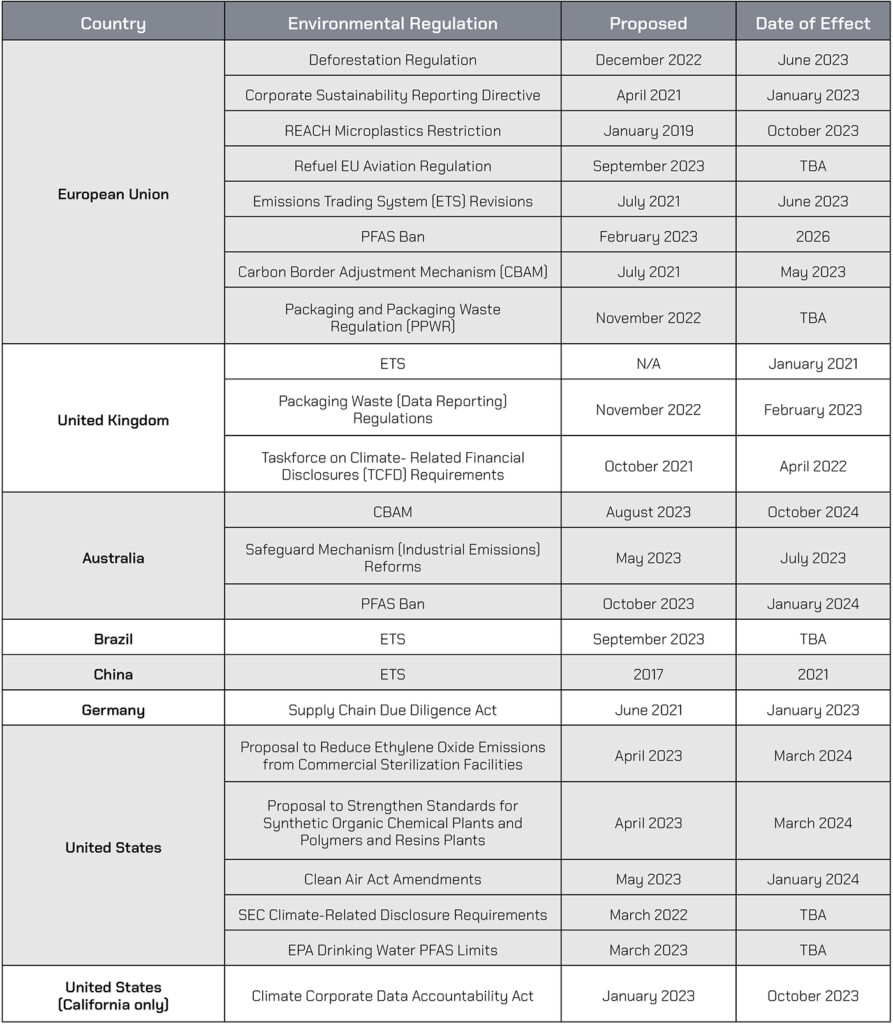

Although many of the new and pending regulations signal actions to broadly cut down on or self-report carbon emissions, there have been an increasing number of industry- and material-specific regulations that could inconvenience and even halt production across multiple sectors in 2024. For example, the EU’s Deforestation Regulation (EUDR) that became effective in June 2023 places new limitations on EU agricultural imports based on ties to deforestation.

In addition to placing administrative burdens and heightened operational costs on both European and non-European companies, the EUDR could motivate financial institutions to withdraw financing to agribusiness projects in higher risk countries. The result could exacerbate commodity shortages or change global commodity flows.

Table 1: Selection of recently passed and proposed environmental regulations by country (Source: Everstream Analytics)

Table 1: Selection of recently passed and proposed environmental regulations by country (Source: Everstream Analytics)

ESG supply chain chemicals regulations stand out

Other regulations target specific chemicals, like the U.S.’s proposals to Strengthen Standards for Synthetic Organic Chemical, Polymer, and Resin Plants and to Reduce Ethylene Oxide Emissions from Commercial Sterilization Facilities. Both regulations target ethylene oxide, a chemical critical in the sterilization of roughly half of all medical devices sold in the US each year. If both are passed in March 2024 (when final rulings are expected), the medical device sector has warned of shortages as manufacturers make updates to factories to conform to new requirements. Smaller sterilizers who are unable to front the costs of equipment upgrades will be forced to drop out of the market, further reducing available sterilizing capacity.

The EU’s Packaging and Packaging Waste Regulation also can impact companies across multiple sectors that operate within the EU. Proposed guidelines from the regulation would impact industries as varied as food and beverage and consumer electronics, which will face increased costs and research and development challenges as they race to secure viable alternative packaging options.

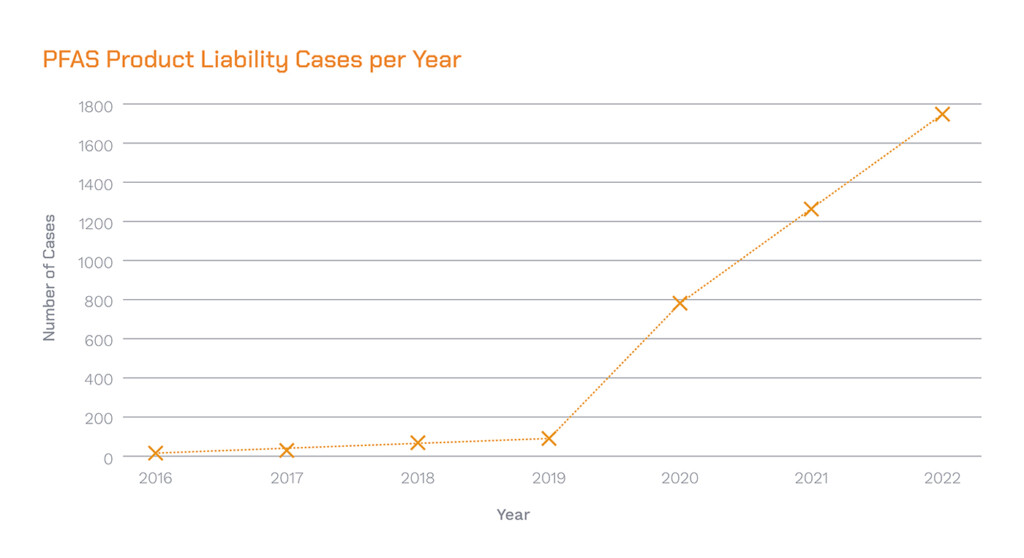

Figure 2: Number of PFAS product liability cases per year from 2016-2022 (Source: Lex Machina).

Figure 2: Number of PFAS product liability cases per year from 2016-2022 (Source: Lex Machina).

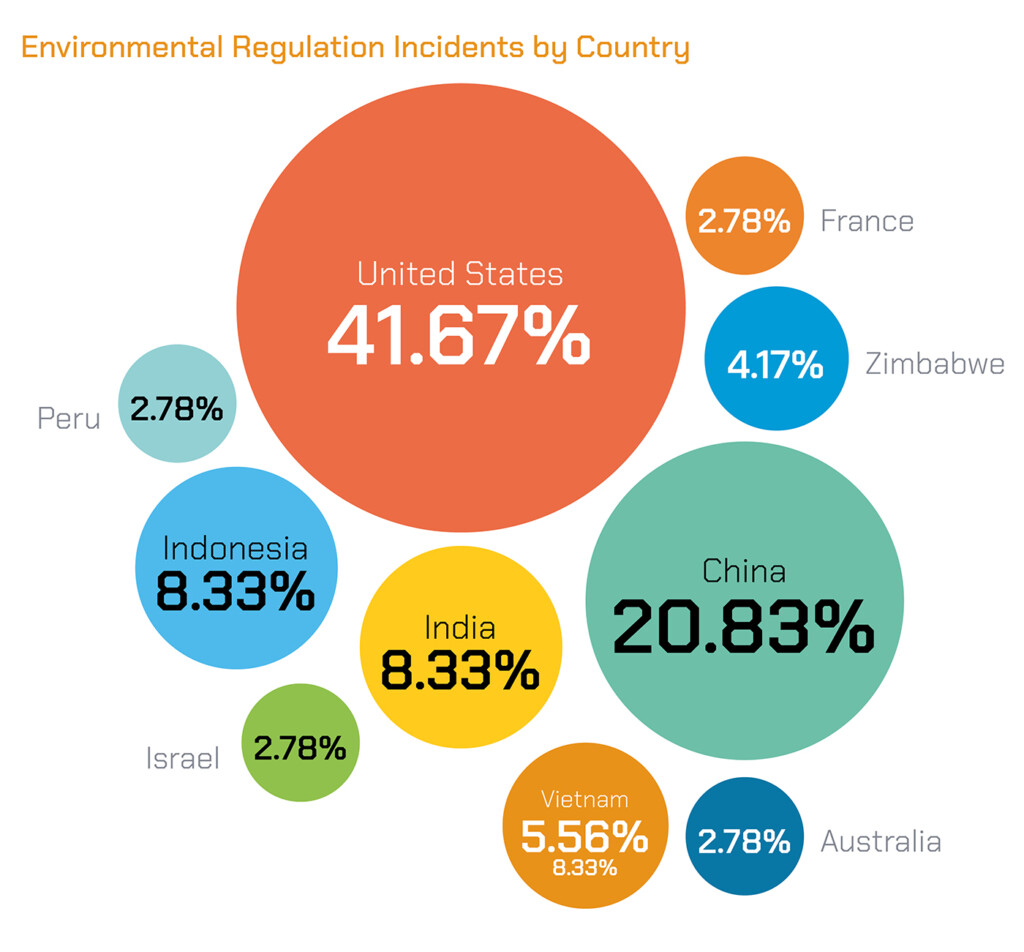

Figure 3: Incidents related to environmental violations in 2023 (Source: Everstream Analytics)

PFAS regulations grow worldwide

PFAS substances are receiving particularly high levels of attention and increasing regulations going into 2024. On March 14, 2023, the US Environmental Protection Agency (EPA) proposed new drinking water regulations for six PFAS chemicals, marking the first such proposal for any PFAS. The EPA has also noted in its 2021-2024 PFAS Strategic Roadmap that the agency plans to tackle Effluent Limitations Guidelines (ELGs) to restrict PFAS discharges from multiple industrial categories in 2024.

Australia has recently promised to ban three types of PFAS by the start of 2024. And in the EU, an even stricter proposed regulation would ban all PFAS, including fluoropolymers. While this proposal would not come into effect until about 2026, multiple industries reliant on PFAS will have to begin an arduous process of identifying and attempting to find suitable alternatives for the materials in their supply chains as soon as possible.

PFAS litigation sets records

Litigation regarding the use of PFAS substances, which was already increasing year-on-year, is likely to only grow with the introduction of these regulations. With increasing PFAS litigation, there is mounting concern of a rise in related corporate bankruptcies in 2024 and beyond.

The first bankruptcy related to PFAS liabilities hit the manufacturer Kidde-Fenwal on May 14, 2023, after the company was named as a defendant in thousands of cases in the MDL. The size of other settlements suggests other companies involved with PFAS pollution may face crippling resolutions as well; 3M reached an historic $10.3 billion (€9.44 billion) settlement, and several chemical makers including Chemours, and Corteva reached a $1.185 billion (€1.086 billion) settlement over claims of PFAS in drinking water this year.

In general, production stoppages and litigation related to environmental violations are on the rise. Disruptions related to environmental regulations are particularly strong in the U.S., where nearly half of such incidents in 2023 occurred.

Supporting ESG supply chain management

Knowing your entire value network will be critical to comply with an increasing number of ESG regulations. Companies will have extensive financial, contractual, and other responsibilities toward their suppliers and other partners. To execute these responsibilities, supply chain managers will need full visibility into risks and violations.

Digital supply chain maps can provide automated management and valuable insights for assessing, monitoring, reporting, and mitigating potential violations. Risk management platforms can integrate with a company’s existing systems to add key insights and support due diligence and compliance.

Learn about other upcoming supply chain risks in our 2024 Risk Report