Although pandemic lockdown-related supply shortages ended by the second half of 2023, raw material supply shortages continued throughout 2023. Many factors contributed to scarcity, including high input prices, farm profitability concerns, increasing protectionism, rising global temperatures, and major weather events such as droughts and floods.

The supply of many raw materials has failed to normalize, and key product prices will remain highly volatile in 2024.

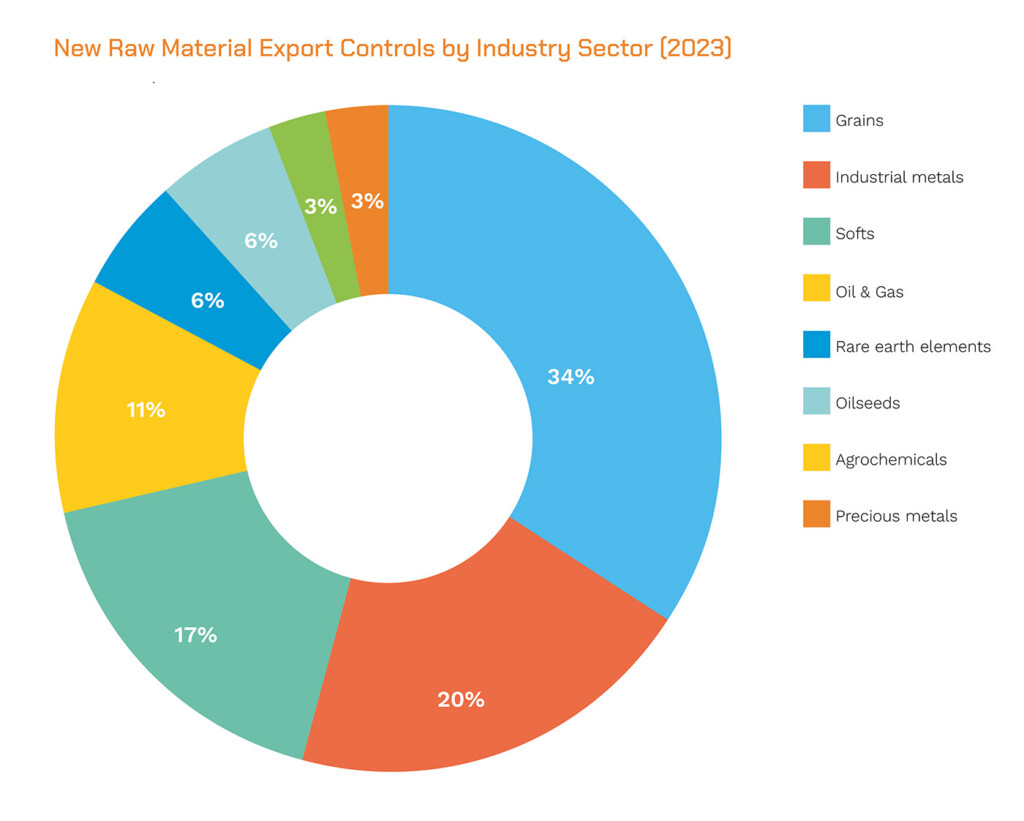

Given the long-term nature of these root causes, current supply shortages are unlikely to subside any time soon, and additional material shortages will arise as changing economic and weather conditions present challenges for new commodities. In 2023, national governments addressed these challenges to domestic supply by implementing nearly 35 new export bans and controls on key raw materials including grains, sugar, and metal ores.

LEARN ABOUT OTHER UPCOMING RISKS IN OUR 2024 RISK REPORT

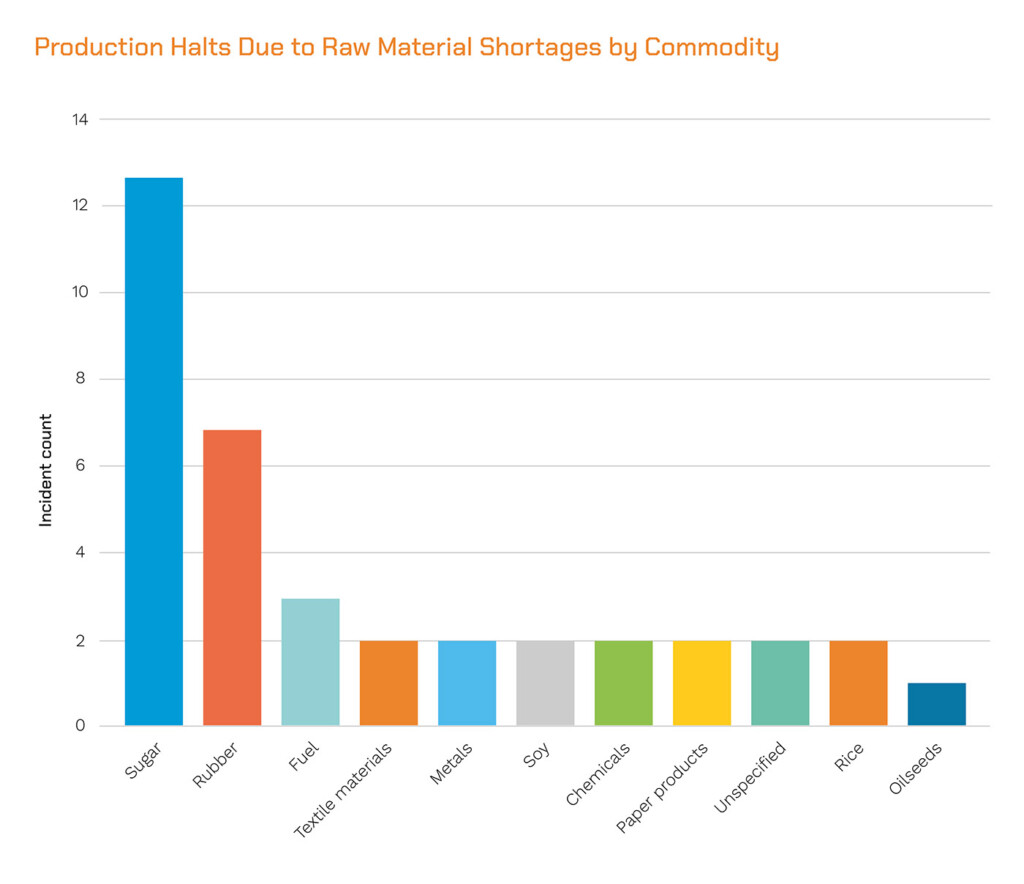

Figure 1: Raw material shortage-related production halt incidents by commodity (source: Everstream Analytics).

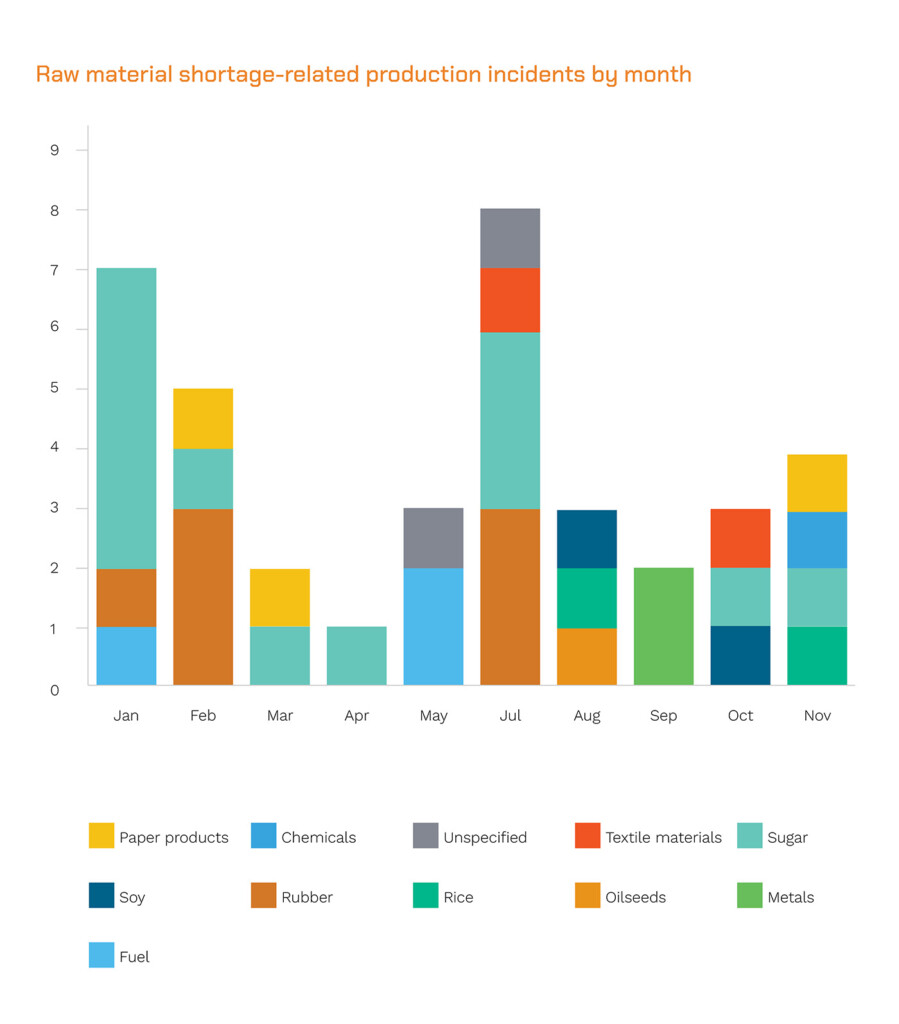

Figure 2: Number of raw material shortage-related production halt incidents throughout 2023 (source: Everstream Analytics).

Commodity supply chain shortages halt production

Amid worsening material shortages and an increasing drive to protect key raw materials, new measures are likely to be proposed or expanded in 2024, causing further disruptions with limited warning.

Throughout 2023, Everstream tracked production disruptions caused by raw material shortages. These disruptions affected a variety of sectors including food and beverage, clothing and apparel, and industrial metals.

The commodities most affecting production were raw sugar and natural rubber; while rice and soy also caused disruptions. Many sugar refiners expect production halts to continue at least through the beginning of 2024, with further production dependent on weather conditions during the 2024-25 growing season.

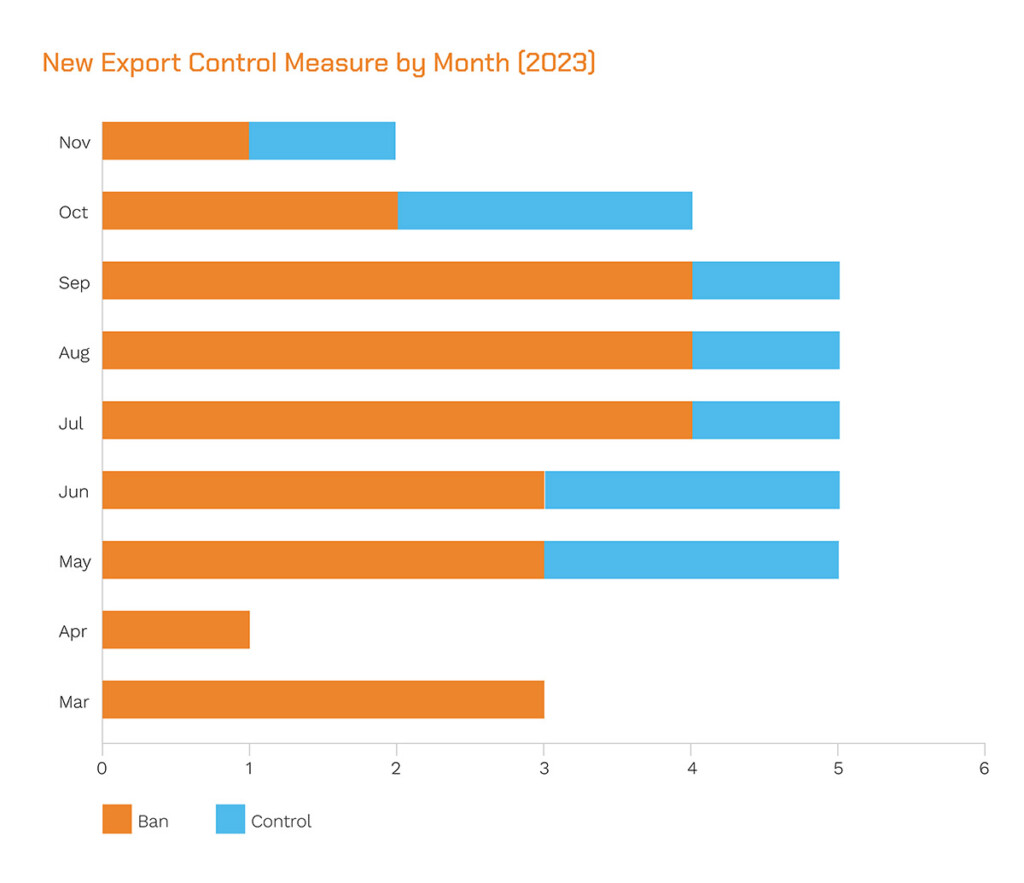

Figure 3: New export controls and complete export bans announced in 2023 (source: Everstream Analytics).

Figure 4: New raw material export controls announced in 2023 by industry sector (source: Everstream Analytics).

Expect more commodity supply chain export bans

Concern for protecting domestic raw material prices and supplies led to new export bans and controls on key commodities, particularly in the agriculture and metals sectors. Countries restricted exports of key agricultural commodities, particularly rice and sugar, to protect domestic food security. An impactful example is when India, Thailand, and Pakistan, which collectively produce 28% of the global sugar supply, announced and implemented new export limits on sugar that further crippled sugar markets.

As commodity scarcity continues through the new year, governments are likely to prioritize domestic interests and propose or expand protectionist measures towards raw material exports.

Introducing Commodity Risk Insights from Everstream

To help support commodity risk management, Everstream has launched new commodity risk insights in Everstream Reveal. Commodity Risk insights help avoid vulnerability and uncertainty by providing advanced, contextualized monitoring of critical commodity events related to metals, agricultural materials, and more through the Everstream Platform, for end-to-end risk management from raw material to destination.

- Curated Commodity Insights: Our intelligence analysts and applied meteorologists keep a vigilant eye on potential risks, providing detailed analysis and network context.

- Real-Time Incident Alerts: Clients receive immediate notifications about commodity events that could affect their material supply.

- Assess Risks to Pivotal Mining Locations: Everstream monitors key mine and smelter locations for disruption and potential risks, providing an assessment of likely shortages.

- Understand Value of Impacted Products: Evaluate the effects of commodity supply changes on Tier 1 operations to prioritize action.

- Daily and Weekly Digests: Summarized reports keep you informed on the latest developments.

- Robust Commodity Dashboards: Dive deep into trends and data analytics to understand your risk landscape, country heatmaps, and more.