The coming year will highlight a growing supply chain gap between China and the West based on increasing trade war restrictions and shifting technology investments. While waiting for new semiconductor plants to come online, many companies will face sourcing problems for high-tech components previously available from Chinese suppliers.

Trade relations between supply chains in China and the West have been increasingly souring, and numerous companies have already begun to diversify where possible if their supply chains are reliant on Chinese inputs. However, as tensions between the U.S. and China continue to rise, 2024 will likely see further protectionist measures in the form of export controls and sanctions. Such actions will force companies to search for new suppliers or risk disruptions to inputs as more and more commodities and products are enveloped in heightening trade wars.

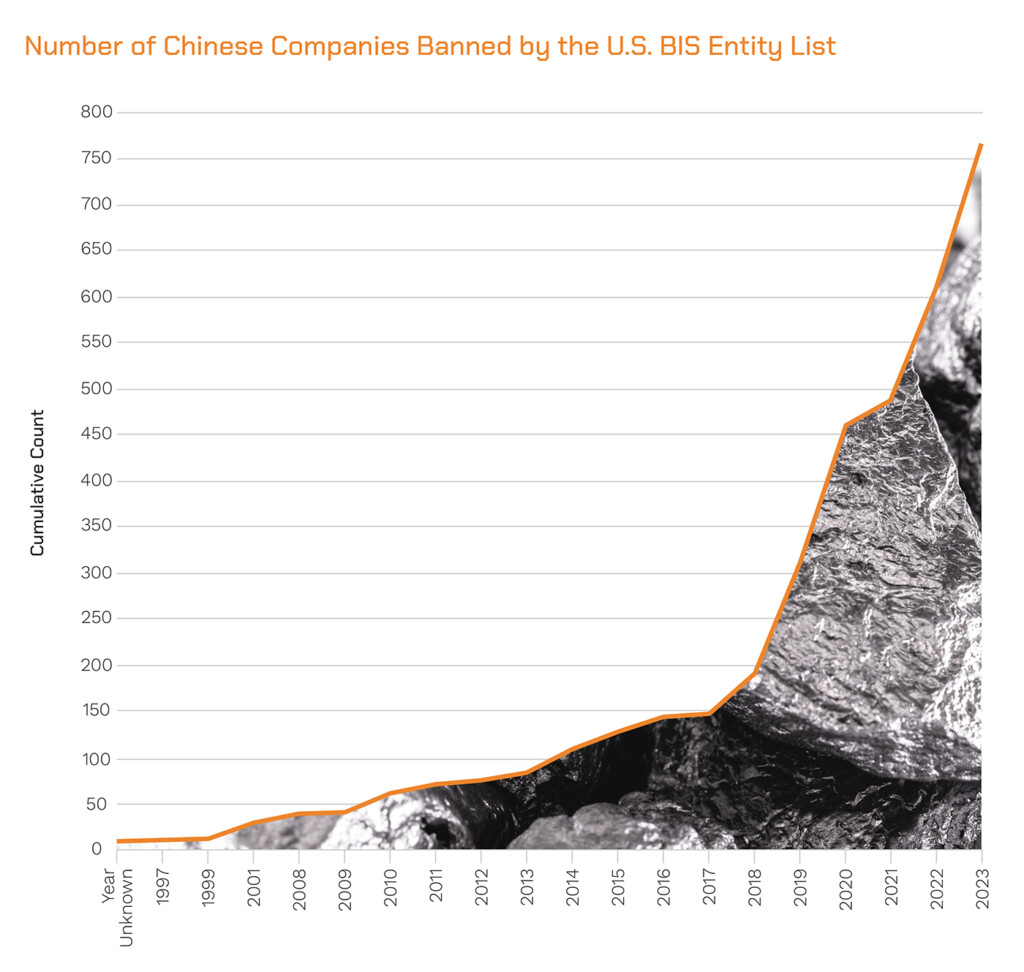

Figure 1: Over the past five years, a rising number of Chinese manufacturing entities have been banned by the U.S. (source: Everstream Analytics).

Waves of supply chain controls against China

The first wave of controls on semiconductors came out of the U.S. in October 2022, when the government announced it would ban the sale to Chinese companies of certain chips used for supercomputing and artificial intelligence. Since then, restrictions out of the U.S. and China have grown significantly, expanding to include export controls on special nuclear material out of the U.S., and semiconductor production equipment out of the Netherlands and Japan.

LEARN MORE ABOUT 2024’S TOP 5 SUPPLY CHAIN RISKS IN OUR ANNUAL RISK REPORT

In October 2023, the U.S. again strengthened its previously announced export controls on semiconductor technology and added additional companies to its growing Entity List, which restricts exports, reexports, and transfers to designated companies. China responded with export controls on items like drones and critical inputs including gallium, germanium, and graphite. China has also threatened to further restrict exports of rare-earth elements, which could impact production of products like high-performance magnets.

Supply chain “China plus one” strategy

Amidst these growing tensions, companies are looking to shift to what’s often referred to as a “China plus one” strategy, in which supply chain dependencies on China are minimized through diversified sourcing.

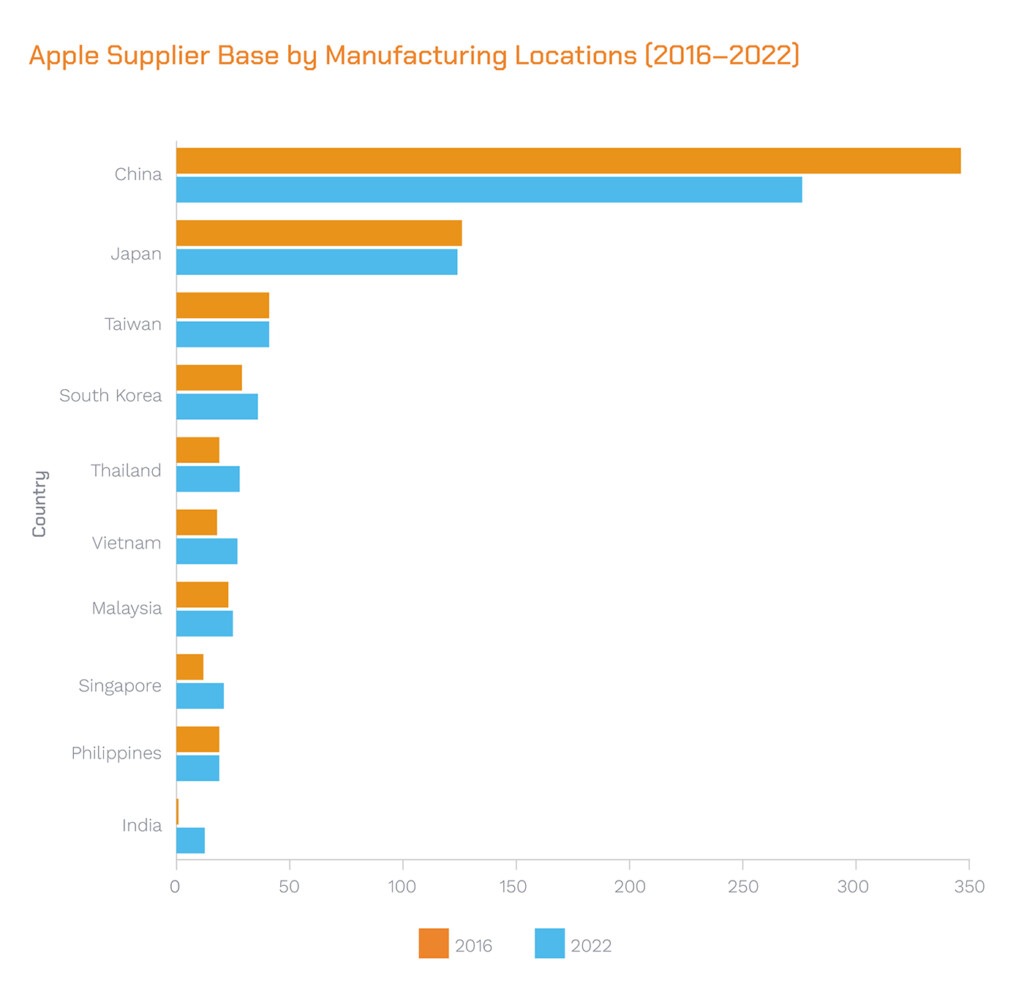

Figure 2: Apple has led the supply chain “China plus one” diversification strategy for the past six years (source: Everstream Analytics).

Such diversification is obvious in patterns of technology giants’ supplier bases and countries’ investments in semiconductor fabrication plants. While China remains the primary supplier base for many supply chains, Apple has notably decreased the number of their suppliers located in China in recent years, instead opting for suppliers out of countries like Vietnam, Singapore, and India.

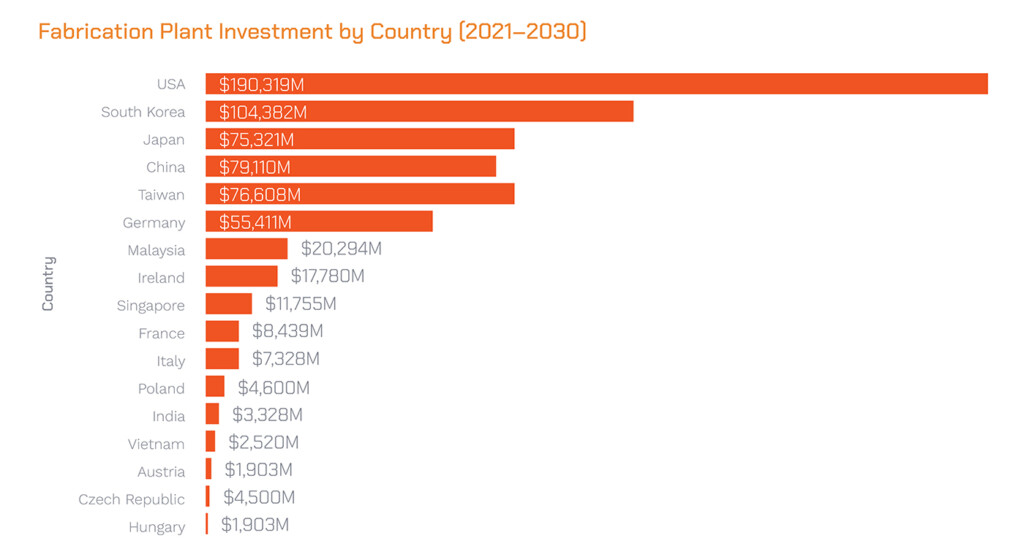

New tech supply chain fabricator investments

To sustain this shifting demand from China, investments in fabricators on a national level from 2021-2030 also show multiple countries working to expand domestic semiconductor manufacturing capacity. The U.S., with about $190 billion (€174.2 billion) in fabrication plant investments, topped the list, while South Korea, Taiwan, and Japan’s investments outpaced investments within China.

Figure 3: The United States leads worldwide investment in new microchip fabrication plants, shifting supply chains away from China (source: Everstream Analytics).

Despite restrictions on imports from the West, China has ramped up domestic production of advanced semiconductor chips using modifications of existing machinery and domestically available technology. While integrated circuit imports have been declining year-on-year from 2021, local semiconductor projects are rapidly growing, signalling increasing self-sufficiency in Chinese manufacturing.

Supply chain raw material controls from China

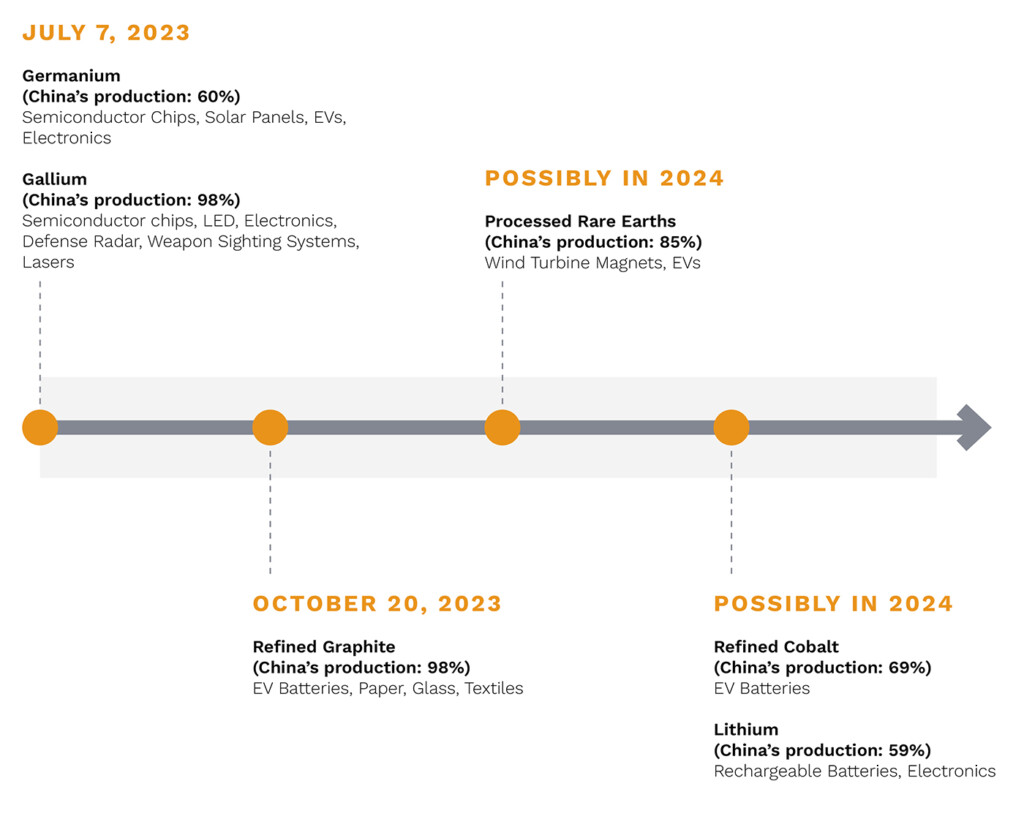

China’s export controls for key raw materials impact sectors beyond the semiconductor industry, indicating that the conflict will continue to expand in 2024 and force decoupling in multiple other industries.

In 2023, China placed export controls on germanium and gallium, key inputs for the manufacture of semiconductors. On October 4, 2023, the European Commission initiated anti-subsidy investigations into EU imports of Chinese electric vehicles, and on October 20, the Chinese government expanded these critical mineral export controls to include graphite, necessary in the manufacture of lithium-ion batteries for electric vehicles.

Increase restrictions marks a shift away from a chip-focused battle between the West and China. It suggests that in 2024, decoupling will feature not only in semiconductor manufacturing, but also the manufacture of technology critical to energy transition.

Figure 4: Timeline of China’s regulations impacting tech supply chains (source: Everstream Analytics).

The Chinese government released additional reporting requirements in late 2023 for the export of rare earth minerals. These requirements further point towards increasing controls in 2024 that could impact high-tech manufacturing, electronics, LEDs, renewable equipment, and the automotive industry.

In 2024, supply chain managers will face more administrative burdens, operational costs, research and development challenges, raised prices, and other disruptions coming from China. This will require shifting production and reporting practices to meet compliance goals.

LEARN MORE ABOUT 2024’S TOP 5 SUPPLY CHAIN RISKS IN OUR ANNUAL RISK REPORT