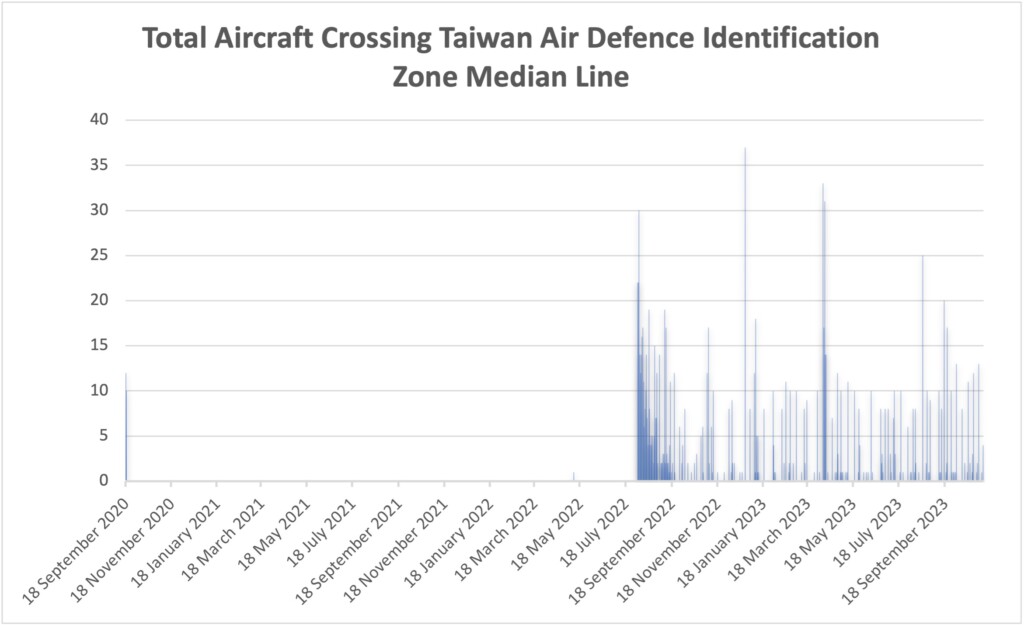

An August 2023 visit to the U.S. by Taiwan’s Vice President and the DPP’s candidate for the 2024 presidential elections, William Lai, also prompted a strong response from China with a further 42 Chinese aircraft and eight vessels involved in drills around the island. Since August 2022, incursions of Chinese military aircraft across the median line of Taiwan’s Air Defence Identification Zone have seen huge increases, with aircraft crossings of the median line exceeding 500 incursions. By comparison, from September 18, 2020 to August 2022, military aircraft had only crossed the median line 23 times.

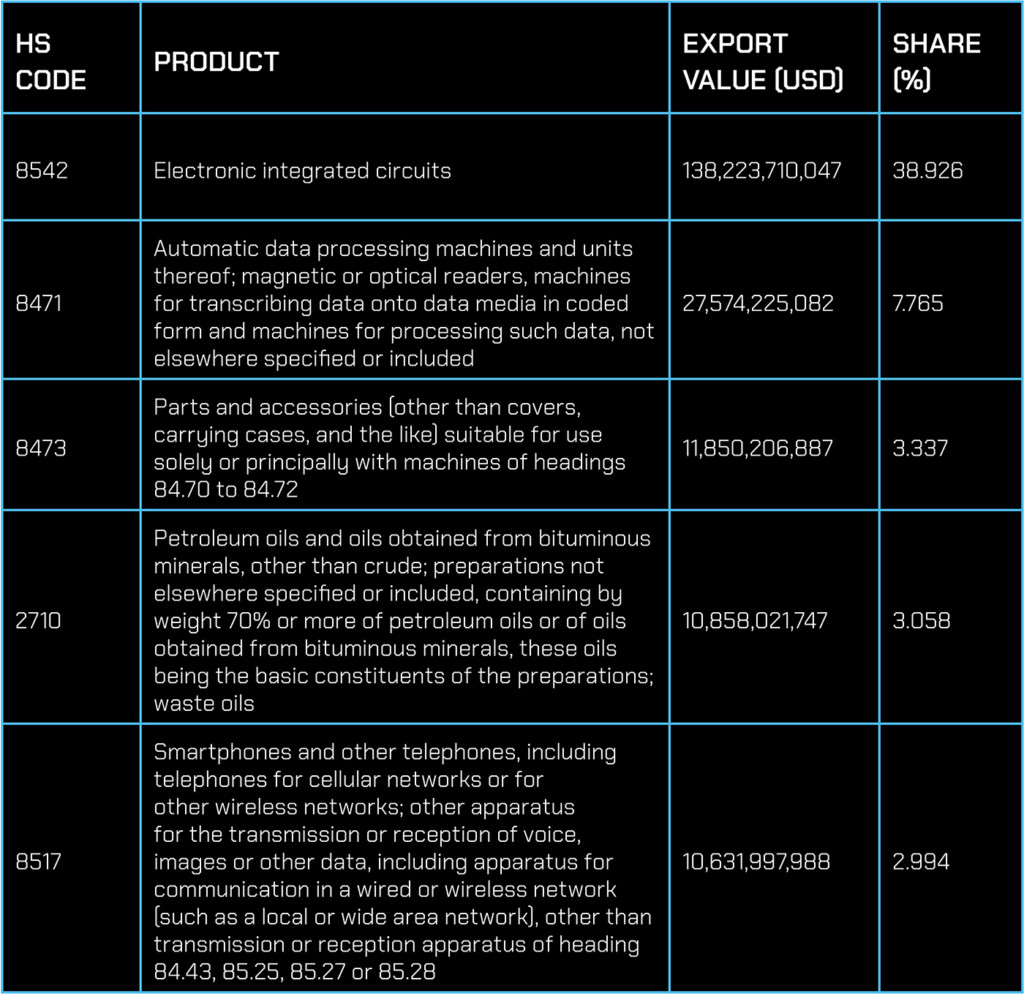

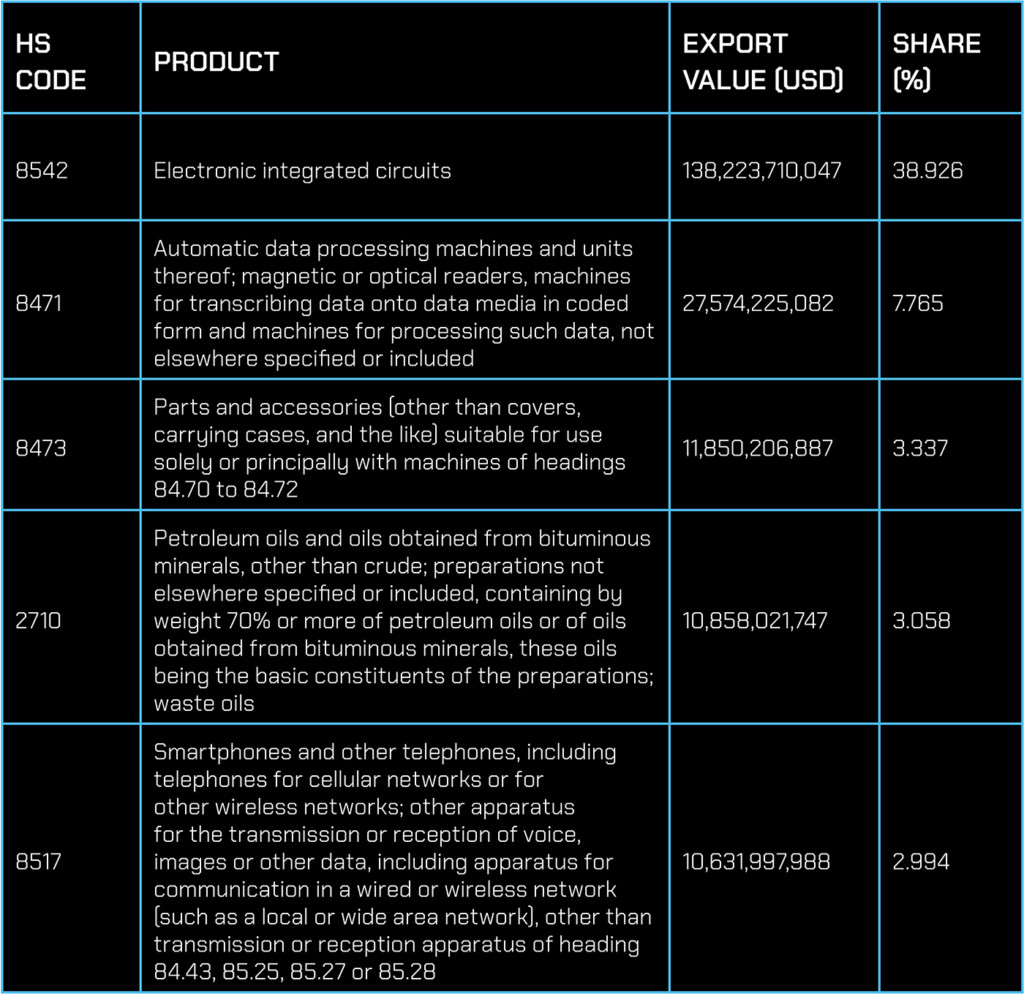

Table 1: Top 5 products exported from Taiwan, January – October 2023 (Source: International Trade Administration of Taiwan)

Regulatory pressure expands

In addition to escalating military tensions, regulatory tensions between China and Taiwan have also risen over the past year. For example, the DPP-led Taiwanese legislature has amended the country’s National Security Act in May 2022 to crack down on technology transfers to Chinese companies. At least four Taiwanese companies are currently under investigation for reportedly helping Chinese technology company Huawei build chip plants in the mainland.

Taiwan’s National Security Council is also preparing a plan to protect a list of critical technologies from China’s intervention by the end of 2023. The upcoming policy is expected to cover the semiconductor, agriculture, aerospace, and IT sectors and will further restrict investments, labour, operations, and transfers of key technologies to the mainland. China responded by launching a tax investigation into local subsidiaries of Taiwanese headquartered contract electronics maker Foxconn. The country also announced new tariffs on certain chemical imports from Taiwan from January 2024, citing discriminatory bans and restrictions on Chinese exports by Taiwan.

Taiwan’s election disruptions

Taiwan’s upcoming presidential election is scheduled for January 13, 2024, and tensions between the island and mainland China are set to increase as the independence leaning DPP looks to fend off a potential coalition of pro-China and centrist parties.

A win by the DPP will likely signal a continued deterioration in Taiwan-China relations. Should the DPP candidate become the next president of Taiwan, more trade restrictions could be launched by China, disrupting the flow of goods to and from the island. Even in the event of a win by the China-backed opposition party, conciliatory negotiations could be degraded by growing Taiwanese support for sovereignty and independence. .

It is also possible that Beijing conducts increasing military drills in the Taiwan Strait to protest Taiwan’s increasing collaboration with the U.S., as was carried out in April and August when U.S. officials paid visits to Taiwan.

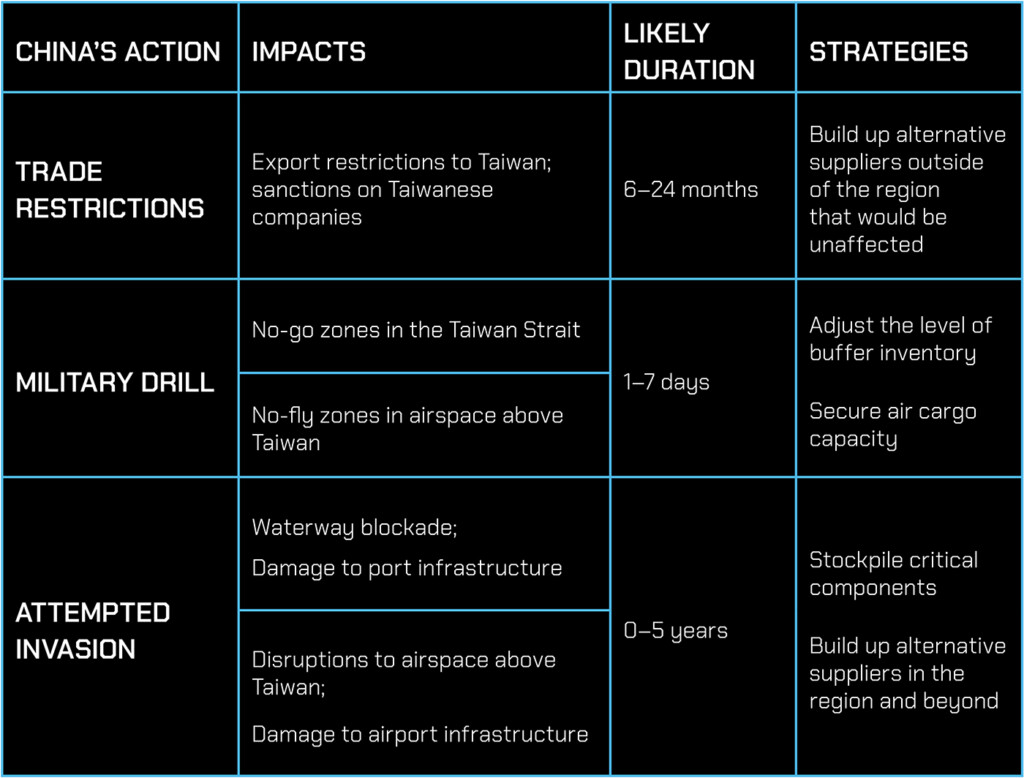

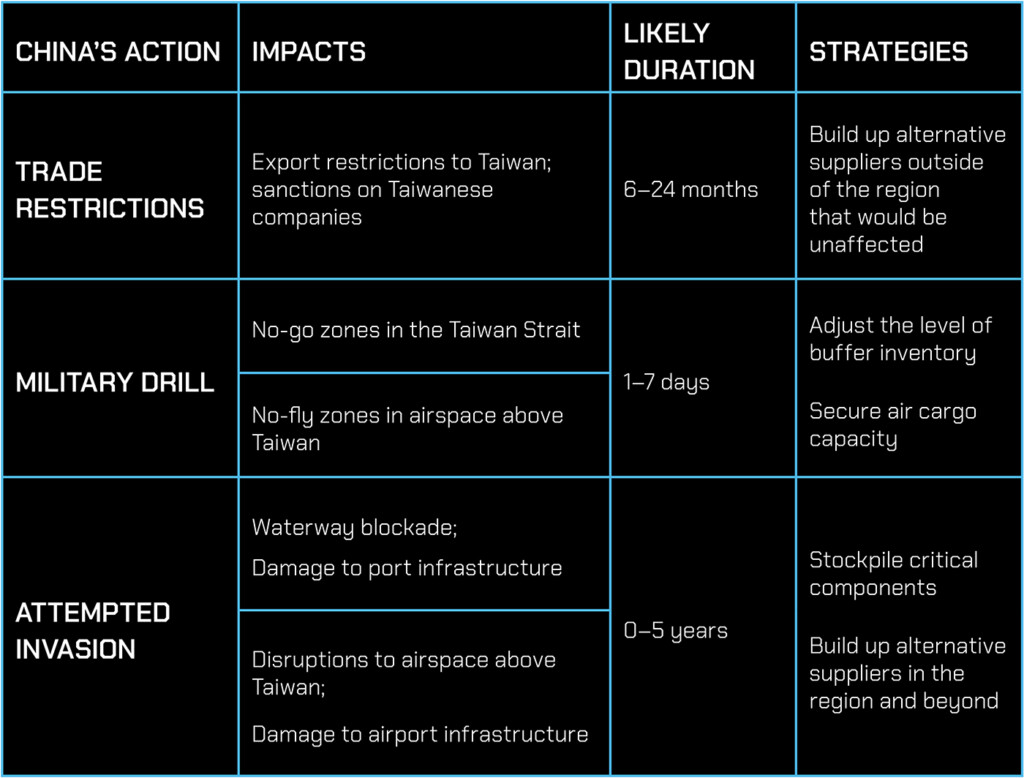

Table 2: Strategies to mitigate risks against Chinese military intervention in Taiwan (Source: Everstream Analytics)

China Taiwan supply chain outlook

Due to Taiwan’s critical importance for semiconductor manufacturing, any further escalation of conflict, whether via cyber-attacks, a naval blockade, limited military operations, or a full-scale invasion, could prove devastating to global supply chains.

If China decides to invade Taiwan in an escalation of the conflict, infrastructure could sustain significant damage and impact its top exports, which include integrated circuits (ICs), electronic components, and petrochemical products.

It is estimated that a Chinese blockade of Taiwan could cause a decrease in global economic output of $2.7 trillion (€2.48 trillion), or 2.8%, in the first year alone, with 60% of this economic loss occurring in China and Taiwan. While such a scenario would most heavily impact Taiwan’s trade with the rest of the world, a blockade would also decrease China’s global trade by an estimated 20% or more, impacting exports of electronics, textiles, plastic, rubber, chemicals, and base metals. Additionally, interruptions to the Taiwan Strait, through which an estimated half of all container ships passes, would deeply disrupt shipping to and from South-East Asia.

Taiwan is the leading producer of semiconductors, and as the third largest recipient of investments into semiconductor facilities set to operate from 2021 to 2030, it is set to maintain a significant role in the sector. It would take an estimated $350 billion (€320.9 billion) and three years to replace Taiwan’s semiconductor capacity in the event of an extended disruption. While outcomes to the global supply chain may vary under different conflict scenarios between China and Taiwan, friction between the two countries is likely to increase in 2024, and companies should prioritize identifying their dependencies on Taiwanese suppliers.

Figure 1: Total aircraft incursions across median line of Taiwan’s Air Defence Identification Zone (Source: Global Taiwan Institute, 2023)

Figure 1: Total aircraft incursions across median line of Taiwan’s Air Defence Identification Zone (Source: Global Taiwan Institute, 2023)