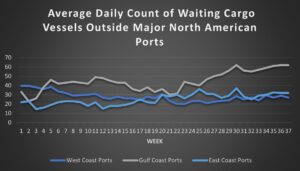

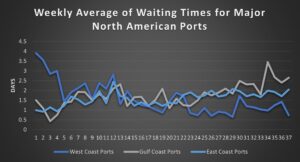

Concerns grow that the ILWU and West Coast employers won’t be able to reach a deal without a work stoppage as both sides appear to be deadlocked. Despite the lack of progress, neither side has hinted that an impasse is developing. Concerns and hesitancies around the viability of West Coast ports have continued as more cargo flows are being directed to East and Gulf Coast ports.

Recent Biden administration involvement in negotiations with Class-I rail companies and over 125,000 rail workers suggest that politicians will not allow significant disruptions to occur in critical supply chain network in the event of an impasse in labor negotiations. The Executive Director of the Port of Long Beach Mario Cordero said this week that he believes the government will step into the ILWU-PMA negotiations in a similar fashion to the administration’s involvement in the railway dispute if negotiations fail. However, government officials are unlikely to get involved unless a significant disruption is threatened. If the ILWU and PMA continue negotiations without threatening disruptions, months of uncertainty will plague West Coast ports.

The labor negotiations have made East and Gulf Coast ports an attractive option, even amidst record congestion at many of the larger ports. East and Gulf Coast terminals and storage facilities have been unable to keep pace with the volume increase and many storage areas are at or exceeding capacity.