Talks between the International Longshore and Warehouse Union (ILWU) and the Pacific Maritime Association (PMA) continue in secrecy with no signs of imminent issues such as an impasse or strike threats. The parties continue to move forward with discussions, likely redoubling efforts to settle the contentious issues of automation and wages.

Negotiations carry on with relatively low congestion at West Coast ports and new regulations. The passage of the Ocean Shipping Reform Act (OSRA) and new scrutiny of U.S. ports under the Federal Maritime Commission (FMC) may have strengthened the ILWU’s negotiating position as both measures seek to increase oversight of operations in the shipping industry. The new regulations also align with the ILWU’s argument that the shipping industry is riddled with excessive profit-seeking.

Meanwhile, the expected surge of Chinese imports has been blunted by lackluster demand for imported goods and disrupted Chinese manufacturing output amid new COVID-19 lockdowns. China’s manufacturing sector has reportedly contracted due to the lockdowns, with the official manufacturing purchasing managers’ index pulled back to 49.0 in July from 50.2 in June. This has been compounded by overstocked warehouse inventories in the U.S. As companies stockpiled merchandise to avoid shipping bottlenecks, warehouses exceeded capacity faster than goods were being sold due to unprecedented levels of inflation and, consequentially, low household purchasing power. Some estimates say that another 800 million square feet of warehouse space is needed to handle the current bloated inventories.

With bloated inventories and falling rates to U.S. West Coast ports, the current situation will likely push any significant import surge from China to Chinese Golden week from October 1-7. This will increase the likelihood of disruptions coinciding with the holiday shopping season.

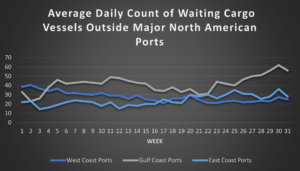

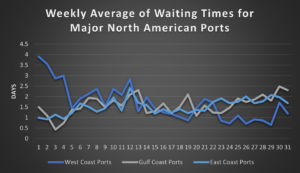

Wait time trends

Average waits continued to climb at the Port of Los Angeles-Long Beach to 1.6 days on average, with average daily vessel counts of six vessels at anchor. Despite the wait time increase, the average of vessels at anchor remains significantly lower on the quarter, down around 60%. In contrast, the Port of Oakland fell to around nine-hour waits (.37 day waits, down 74% from last week) and the Port of Seattle was able to clear its backlog of waiting vessels and eliminate waits entirely. China/Asia to U.S. West Coast spot rates reflect the trend of weaker demand on the route, falling 7% to $6,149/FEU (€6,042/FEU). Overall waits at West Coast ports slightly decreased from the past week.