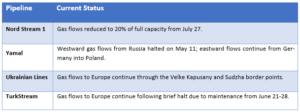

Governments and companies in Europe remain vulnerable to a reduction in energy supply from Russia as the continent scrambles to fill up its gas storage facilities for the upcoming winter. As of July 27, gas flows to Europe through the Nord Stream 1 pipeline have been reduced to around 33 million cubic meters of gas per day, just 20% of the pipeline’s full capacity. Nord Stream 1 had initially resumed operations at around 40% flow capacity on July 21 following a 10-day annual maintenance shutdown. However, according to a recent statement by Gazprom, gas flows through the pipeline have been reduced on the orders of a Russian industry watchdog due to an alleged issue with a Siemens turbine, an explanation that has been disputed by the manufacturer as well as authorities in Europe, including the German government.

These developments came on the heels of a key agreement reached by EU member states on July 26 to voluntarily reduce gas usage from August 1, 2022, to March 31, 2023 by 15%, with the option to make the reduction target mandatory in the event of a supply emergency. However, the plan includes several opt-out clauses allowing countries to request exemptions if they surpass gas storage filling targets, if their domestic gas usage increased by at least 8% in the past year in comparison to the average of the previous five years, or if so-called critical industries in a respective country depend heavily on gas usage.

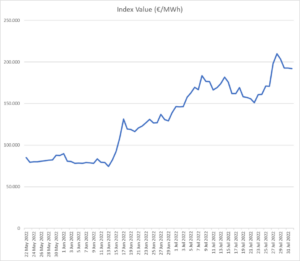

Figure 1: Snapshot of TTF Neutral Gas Price Index (source: European Energy Exchange).