Grains

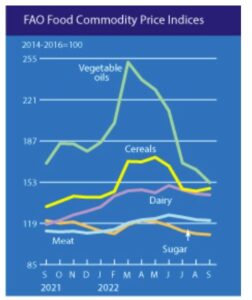

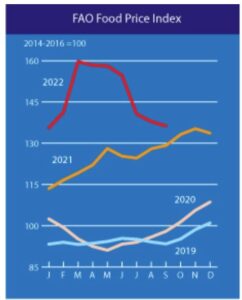

There is heightened uncertainty over grain supply due to questions revolving around the Black Sea grain initiative’s continuation beyond November and the potential impact of Ukraine’s exports. The agreement allowed for the export of significant volumes of commercial food and fertilizers from three Ukrainian ports in the Black Sea since July 22, stabilizing spiraling food prices worldwide. However, international wheat prices have again increased by 2.2% in September. With Russia’s repeated threats to abandon the deal, there is a possible risk of further rising grain prices from November that would threaten food security.

Moreover, the drought spreading across the U.S. Midwest that is drying up the Mississippi River and its tributaries could have serious implications for global food prices. The decrease in water levels has led to barge groundings and delays on the Mississippi and Ohio Rivers, which are among the most important routes for U.S. agricultural shipments. About two-thirds of U.S. sea-based grain exports last year departed from the Gulf of Mexico, usually after being shipped by barge down the Mississippi River. U.S. wheat crop is expected to be the second lowest in 20 years for October 2022.

Rice

Pakistan is a major rice producer, and recent severe flooding events across the country have been posing high risks to the upcoming wheat planting season, which usually takes place from mid-October through November. Pakistan’s rice output projected for 2022-23 was revised down to 8.3 million tons, well below the previous year’s record total of 9.1 million. India’s ban on broken rice exports started in September in a bid to control domestic prices and affects multiple countries, accounting for approximately 40% global rice shipments. The reduced supply of rice from India will impact other major rice producers and exporters including Thailand and Vietnam.

Palm Oil

On October 4, Indonesia, the world’s largest palm oil producer, announced a possible extension of the export levy waiver on edible oil to the end of this year. Previously, Indonesia waived levies on exports of palm oil products from mid-July to reduce stock that was aimed at stabilizing local cooking oil prices. Such measures may be a positive outlook for the industry since palm oil prices have dropped and cost of palm oil-based biodiesel is lower than fossil diesel fuel.

Sugar

Sugar prices have continued to decline for the fifth consecutive month, reaching their lowest levels since July 2021. The underlying reasons for this were good production prospects in Brazil, the largest sugar exporter worldwide, as well as record-high exports out of India, making it the second largest exporter globally in the 2021-2022 season that ended in September.