After reaching a tentative agreement on health benefits, negotiations between the International Longshore and Warehouse Union (ILWU) and the Pacific Maritime Association (PMA) have retreated behind closed doors. The parties continue to move forward with discussions, now focusing on the remaining, more contentious issues of automation and wages. New legislation under the Inflation Reduction Act of 2022 provides U.S. ports with access to $3 billion (€2.94 billion) in federal grant funding. However, a caveat of the legislation is that ports cannot use the funding to increase automation, strengthening the ILWU’s negotiating position on the matter.

Neither side has given any indication that port disruptions will occur because of negotiations. On the contrary, both parties have reiterated their commitment to reaching an agreeable solution without the need for widespread disruption. However, cargo delays from ports in Europe could impact U.S. ports, particularly on the East Coast. Workers at the Port of Felixstowe, the U.K.’s largest container port, voted to take strike action from August 21-29 after rejecting the most recent labor agreement proposed by port owner and operator, CK Hutchison Holdings Ltd. As with recent strikes at ports in Germany, disruptions at the Port of Felixstowe could delay cargo vessels, force carriers to skip scheduled ports of call, and cancel sailings altogether. Irregular and unpredictable vessel arrivals could spike in the coming weeks at U.S. East Coast ports, increasing vessel wait times.

Despite unresolved negotiations, the situation for U.S. West Coast ports is generally positive as congestion levels have fallen from pandemic highs. Spot rates have fallen below contract rates on U.S.-Asia routes, signaling that demand is cooling. U.S. retailers forecast that imports in August could fall by as much as 3% year-over-year, a trend that is likely to continue through the remainder of 2022 and into 2023. As U.S. West Coast ports, particularly the ports of Long Beach and Los Angeles, handle the bulk of total U.S. imports, the cooling trends will manage congestion levels. This, of course, will only be the case barring any industrial action resulting from failed negotiations.

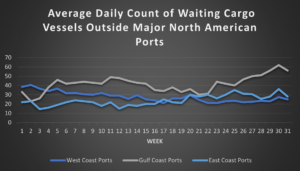

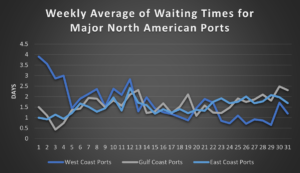

Wait time trends

Wait times increased at the Port of Los Angeles-Long Beach to 21.6 hours (0.9 days) on average with average daily vessel counts of seven vessels at anchor. Despite the increase, the numbers are still down on the quarterly average. Landside rail issues continue to pose a challenge to cargo flows out of the ports. Rail metering by Class I carriers BNSF and Union Pacific has some import containers sitting idle for six weeks or longer. Average vessel waiting times for the combined U.S. West Coast ports fell from last week.