Major disruptions in CO2 supplies leave producers short-stocked, particularly in Europe, disrupting food making, beverages, and healthcare.

Why is there a CO2 shortage?

Major disruptions in CO2 supplies have left producers short-stocked in recent months, particularly in Europe. There, the intensifying energy crisis caused by the Ukraine war and sanctions against Russia has boosted energy costs to unprecedented heights over the past seven months.

Skyrocketing energy costs have led once-stable fertilizer plants to cut production, and in some cases to shut down altogether for prolonged periods of time. So far, production impacts have been reported at some of the continent’s largest fertilizer plants, including at key manufacturers CF Industries and Yara International. Fertilizer plants create CO2 as a by-product of synthesis gas production, namely in the manufacturing of ammonia and hydrogen gases.

Other disruptive events coincided with energy-related production halts on the continent, including needed maintenance work at plants in Europe and contamination issues at plants in other parts of the world, blocking those plants from replacing missing supply from Europe.

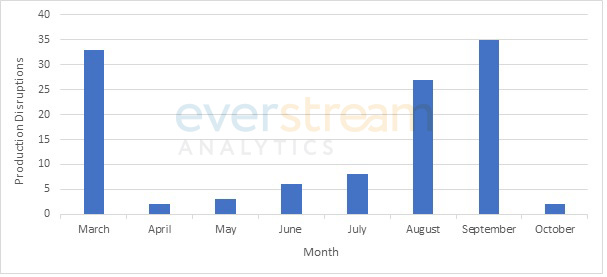

These concurring disruptions highlight how quickly gas shortages can hit industries relying on stable CO2 supplies, particularly food, beverage, and healthcare. With the energy crisis likely to continue as the region heads into the colder months of fall and winter, further CO2 supply disruptions should be anticipated in the months to come.

Rising energy costs impact several CO2 producers

Initial production impacts started in Ukraine, with the Odesa Port Plant shutting chemical production in February and extending its stoppage due to high gas prices, effectively halting yearly volumes of around one million tons of ammonia and 800 thousand tons of urea. The impacts of the invasion did not stay in Ukraine, however, as Russia’s curtailment of gas caused European producers to wind down production in recent months.

The trickle-down effect of falling CO2 volumes to distributors caused disruptions across various sectors, most notably in food making, beverage, and healthcare.