Did you know Apple increased its supplier network in Thailand by over 100% since 2019? They aren’t alone. Between 2019 and 2024, some of the world’s largest technology companies diversified their supply chains. Vietnam, India, Malaysia, and Taiwan are the most common alternatives to China. What’s driving these changes? More importantly, what supply chain diversification lessons can procurement leaders learn from these tech giants?

Changing mindsets, changing suppliers

For decades, China has been the technology industry’s manufacturing powerhouse. Its unparalleled scale, skilled labor force, and cost efficiency made it the obvious choice for businesses worldwide.

Over the past decade, labor costs in China have steadily increased. This had made manufacturing less attractive from a cost-efficiency standpoint.

In addition, the COVID-19 pandemic brought into sharp relief that many technology companies were overdependent on China.

China’s zero-COVID policies led to strict lockdowns, factory closures, and shipping delays. This disrupted key tech supply routes in unimaginable ways.

Thirdly, significant trade tensions remain. The U.S. and China recently agreed to deescalate the ongoing trade war.

In early July, the U.S. announced that it had agreed to a framework deal with China. China agreed to loosen restrictions on the export of rare earth minerals and magnets in exchange.

However, no deal has been finalized, and the situation remains fluid.

Technology companies understand that supplier diversification is a risk-optimization procurement strategy. It reduces exposure associated with single sourcing critical parts and materials from one country. Diversification adds flexibility and agility by spreading risk across several countries and suppliers.

Emerging markets in the technology supply chain

This diversification wave has spotlighted a collection of countries rising as manufacturing powerhouses. Here is where different countries have specialized.

Figure 1: High tech manufacturing in Asia has resulted in country-specific expertise

Figure 1: High tech manufacturing in Asia has resulted in country-specific expertise

1. India

- Known for smartphone and laptop production.

- Companies like Samsung and Apple already heavily rely on India for smartphone assembly.

- Boasts a large, skilled workforce and government initiatives like “Make in India” designed to encourage investment in manufacturing.

2. Vietnam

- Emerging as a hub for smartphone and laptop manufacturing for companies like Dell and Apple.

- Benefits from proximity to China, aiding smoother transitions for manufacturing expertise.

3. Thailand

- Rapidly becoming a go-to destination for electronics, smartwatches, and computer components manufacturing.

- Apple and HP, for example, are increasingly shifting operations here, thanks to favorable incentives and skilled labor.

4. Malaysia

- Specializes in backend semiconductor processing, including chip packaging and testing.

- Provides an educated workforce and strong infrastructure for high-tech manufacturing.

5. Taiwan

- Dominates the semiconductor production space as home to TSMC, the world’s leading chipmaker.

- Despite geopolitical concerns, Taiwan remains a crucial player for high-tech components like sophisticated 3nm chips.

Each country offers its unique advantages. But none fully replaces China’s scale and ecosystem, at least not anytime soon.

China is still the dominate processor of rare earth raw materials. There are initiatives to become less dependent on Beijing for rare earths. This includes an agreement between the U.S., Japan, India and Australia. However, building the mining and processing capacity will take time.

Diversification is more about complementing China’s role, not replacing it.

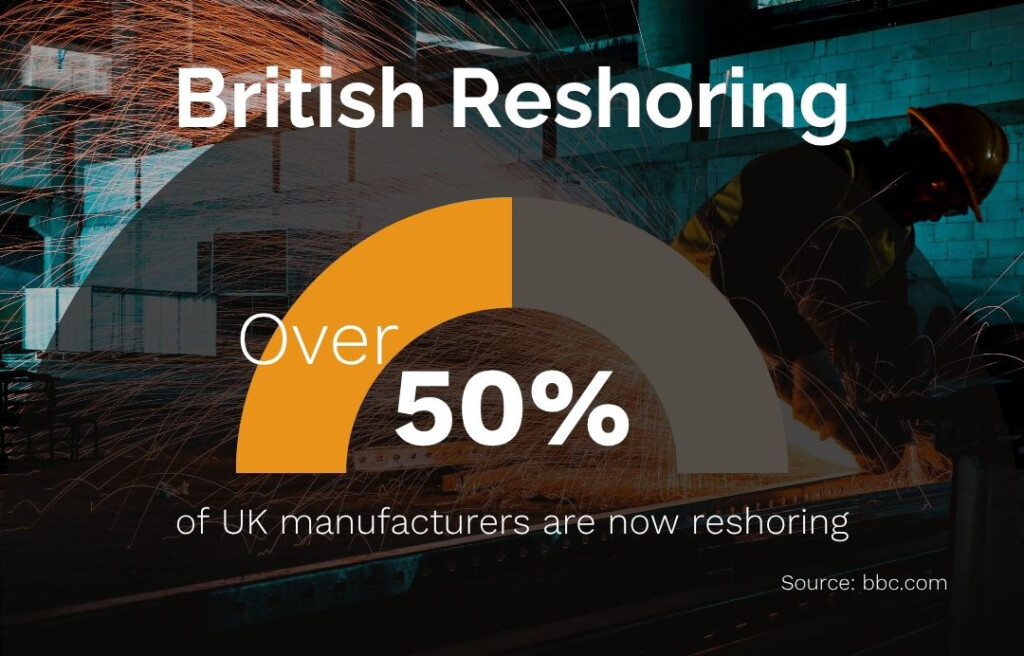

Figure 2: Over half of British manufacturers are reshoring parts of their supply chains

Figure 2: Over half of British manufacturers are reshoring parts of their supply chains