The French protests over pension reform in 2023 significantly disrupted the chemical industry supply chain, causing severe production halts across the country. Striking workers blocked access to key industrial areas, hampered refinery shipments, and created potential diesel shortages, among many other disruptions. Our 2023 Year in Review report identified this as the chemical industry’s top disruption for the year. These events unfolded in a rapid, unexpected manner, leaving little time for contingency planning for companies without robust supply chain risk management support.

Impact on the chemical industry supply chain

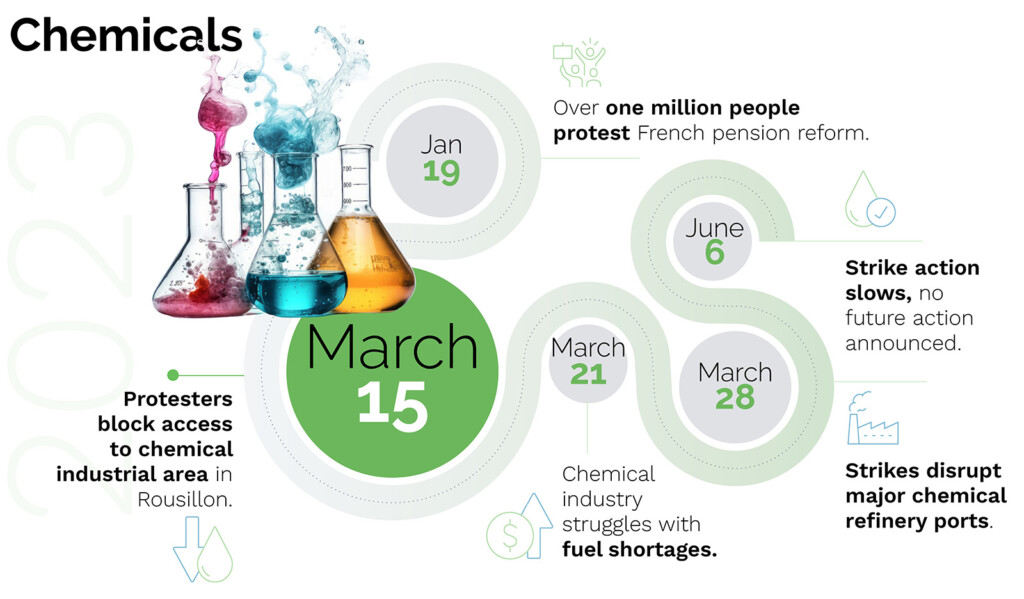

The strikes began on January 19, and over one million people participated, marking the beginning of a nationwide protest movement. Considering that France is Europe’s second-largest chemical producer, the potential impact on the chemical industry supply chain was immediately significant. Nationwide strikes led to production halts at numerous chemical companies, creating ripples in the supply chain due to the sudden drop in output.

Figure 1: The chemical industry supply chain was disrupted heavily by French labor protests in 2023.

By March 15, the situation had escalated. Protesters blocked access to a crucial chemical industrial area in Roussillon, which further jeopardized the delicate balance of the supply chain. Just five days later, French refinery shipments ceased. Tankers carrying refined products and crude oil were unable to enter French ports, leading to a potential diesel shortage – a critical component for chemical manufacturing and distribution.