It’s the top risk facing automotive manufacturers today: The suppliers you choose, and the ones they choose, now define your corporate vision and reputation. Labor violations, bankruptcies, chip shortages, and other disruptions can suddenly appear in what is arguably the most complex supply chain in the world.

Supply chain analytics can mitigate supplier risk. This technology can map a multi-tier supply chain, even one as complex as an automotive OEM, so managers can see and mitigate threats.

Identifying automotive supply chain risks

Automotive OEMs are grappling with severe supply chain challenges in an atmosphere of high pressure from multiple stakeholders, increased public scrutiny, and growing procurement complications.

Now, more than ever, regulations and public opinion hold companies accountable for their supplier violations. Agencies are shifting governance responsibility to corporations, and governments are getting better at monitoring and enforcing due diligence.

OEMs often source from lower-tier chemical, technology, and manufacturing generalists who are also supplying to other industries. These types of businesses can have profoundly different footprints, operating practices, and risk profiles, which require sector-specific expertise to map and understand their operations.

A leading 16% of today’s automotive players have already launched efforts to identify and characterize tier-two suppliers and beyond.

Challenges to achieving supplier visibility

Businesses have direct communication with Tier-one suppliers, but that doesn’t always equate to visibility into those suppliers’ potential shortages or production problems. Collecting full information on sub-tier suppliers is even more challenging. Common methods include:

- Asking direct suppliers to conduct due diligence on their own upstream supply chain.

- Calling for suppliers to provide details as part of a request for proposals (RFPs).

- Sending a code of conduct to direct suppliers and hope it creates a ripple effect up and down the supply chain.

Hope isn’t a strategy. These methods are time-consuming and difficult to enforce; at best, they create an incomplete, one-time snapshot. Suppliers are reluctant to provide information that is often considered sensitive or proprietary.

Network graphing helps mitigate disruption

Digital supply chain management systems can shine light on the structure of supply chain networks, the status of supply chain participants, and how goods flow between them.

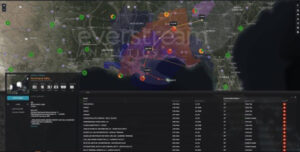

Figure 1: Incident alerts help leading automotive procurement and risk management specialists know which suppliers are at risk of disruption.

When a major adverse event occurs, such as a hurricane, a labor strike, or a regional power outage, there is one question stakeholders ask procurement executives: Do we have affected suppliers? A network graph and supply chain risk analytics can answer this question in real time.

Using analytics to map and identify supply chain risk is not a static exercise: The more useful data and algorithms going in, the better results come out. Analytics companies continually search for relevant data sources, secure data rights, and maintain privacy protection and other data compliance.

Paving new roads

Today’s automotive supply chains are dynamic. Electric vehicles will soon replace the combustion engine, requiring new components. A host of new, often untested, companies will manufacture those components, and they’ll have to scale rapidly from niche provider to mainstream supplier.

Companies that have put in the effort to achieve multi-tier visibility are already reaping the benefits, including 10%–15% greater cost efficiency in inventory and transportation, and higher on-time-in-full deliveries to customers.

Get our State of the Industry report to see other current automotive industry challenges