Since the latter part of 2021, a growing number of companies across Europe have been facing intermittent operational disruptions as energy prices rose sharply due to an increasingly tight global supply of energy sources. Following Russia’s invasion of Ukraine in February 2022, energy costs in the region, where Russian supply accounts for large shares of energy imports in many countries, have climbed even higher, reaching unprecedented heights in the months since the war in Ukraine began.

Energy-intensive manufacturers are bracing for further disruptions and the possibility of permanent shutdowns as European governments work to ensure sufficient energy supply in time for the upcoming winter.

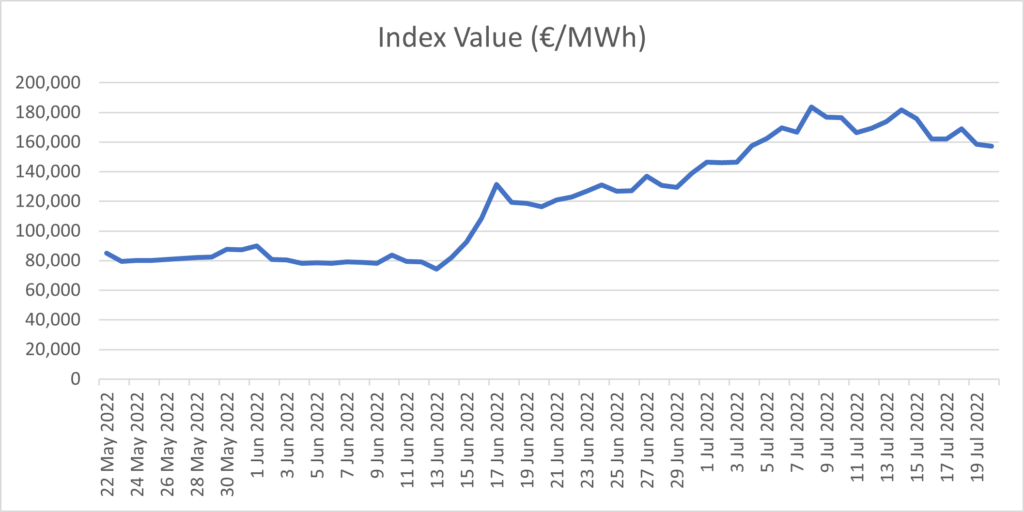

Figure 1: Snapshot of TTF neutral gas price index; Source: European Energy Exchange.

On July 11, the flow of gas between Russia and Germany via both lines of the Nord Stream 1 pipeline stopped completely as annual maintenance work on the pipeline began. Governments and companies in Europe have since voiced concerns that Russian authorities could prolong the shutdown to undermine plans to shore up regional energy storage capacity for the upcoming winter.

Gas flows through the Nord Stream 1 pipeline resumed at 06:00 local time on July 21, however, flows are reportedly running at only 30% of capacity and it remains unclear whether run levels will increase in the coming days. Many countries in Europe are still bracing for the worst, with the European Commission releasing a proposal on July 20 asking member states to voluntarily reduce gas usage from August 1 to March 31 by 15%. If approved, it would also allow authorities in Brussels to make the 15% reduction a mandatory target during a supply emergency.

Beyond external supply issues, plans to shore up energy reserves in the region have also been threatened by a series of strikes in the European energy sector in recent weeks. In Norway, a strike briefly disrupted production at several offshore facilities operated by state-owned energy company Equinor ASA before the government intervened to end the strike. Several labour unions in Spain staged a strike action at Repsol S.A., a Spanish energy and petrochemical conglomerate, from July 15 to 17, with more strikes expected in mid-August if a dispute over wages cannot be resolved. Operations were also impacted at several gas storage sites in the French towns of Chemery, Céré-la-Ronde and Benoît Seyer, where workers of Storengy SAS, a subsidiary of oil, gas, and energy conglomerate Engie SA, staged intermittent strike actions for several weeks to demand a salary increase.

Energy shortages cause growing number of manufacturing disruptions across Europe

Warnings of widespread manufacturing impacts due to insufficient gas supply and rising costs for available energy sources continue to reverberate particularly in Germany as fears of a complete cut off from Russian energy imports intensify. In mid-July, Robert Bosch GmbH, a multinational engineering and technology company, joined a growing list of industrial heavyweights warning of operational impacts at its plants, including a semiconductor factory in Dresden, if Russian gas supply remains curtailed.

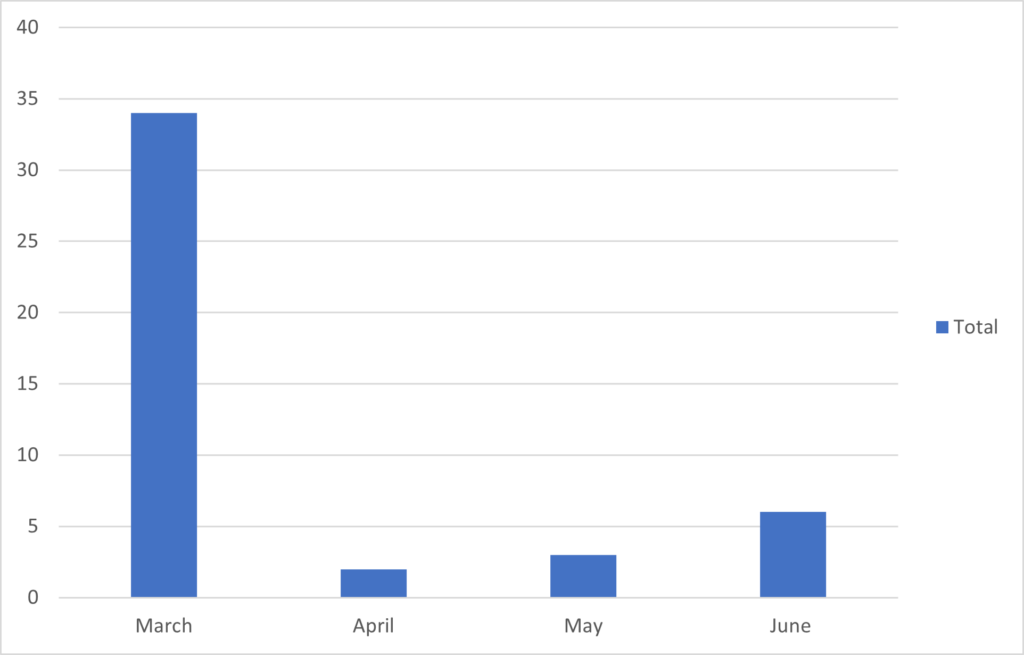

Figure 2: Number of energy-related factory shutdowns in Europe by month; Source: Everstream Analytics.

Disruptions in the manufacturing sector caused by rising energy costs also continue to spread in other parts of the region, including in Romania, where Alum Tulcea, the country’s only aluminum refinery, will halt operations from August, and in Slovakia, where Slovalco, a large aluminum manufacturer, has confirmed plans to lay off hundreds of workers while it considers a complete production halt.

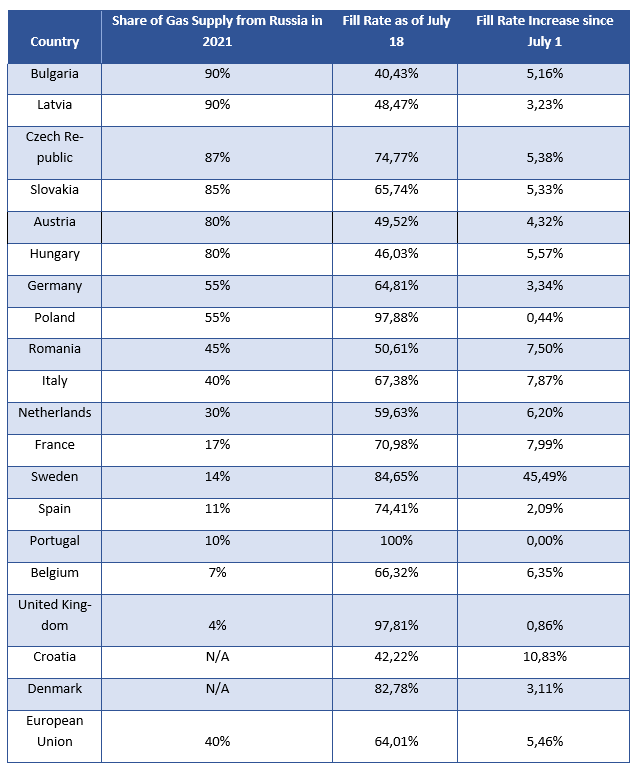

More governments implement mitigations measures as gas storage levels increase at slow pace

As countries continue to shore up gas supplies, several Eastern Europe governments have announced new mitigation measures. Slovenia issued an early warning for a possible nationwide shortage of nat-ural gas if Russian gas supply remains disrupted, with the current stage only enforcing energy saving measures among state-owned facilities. Hungary announced an export ban to other European coun-tries from August 1 as well as plans to boost domestic natural gas production and to restart at least one lignite-fired power plant after an energy emergency was declared. Latvian parliament amended the country’s energy law to impose a total ban on all gas imports Russia starting January 1, 2023, and oblige natural gas providers to form a strategic reserve.

Figure 3: Status of gas storage capacity in selected European countries; Source: Everstream Analytics.

German authorities have yet to announce further actions after the country entered stage two of its gas-emergency plan on June 23; however, additional government measures (such as financial support for struggling utility providers or an extension of the run time of the country’s three remaining nuclear power plants) have become more likely.

Outlook

Energy-intensive industries including chemicals, textile, paper, or aluminum manufacturing will remain at high risk of further operational disruptions throughout the second half of 2022 if Russia cuts off energy supply permanently and a colder-than-usual winter hits the continent later in the year.

Everstream customers are receiving detailed information about this disruption.

Contact us to learn how we can give you a complete view of the risks affecting your end-to-end supply chain and what you can do to mitigate them.