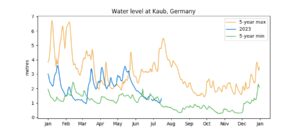

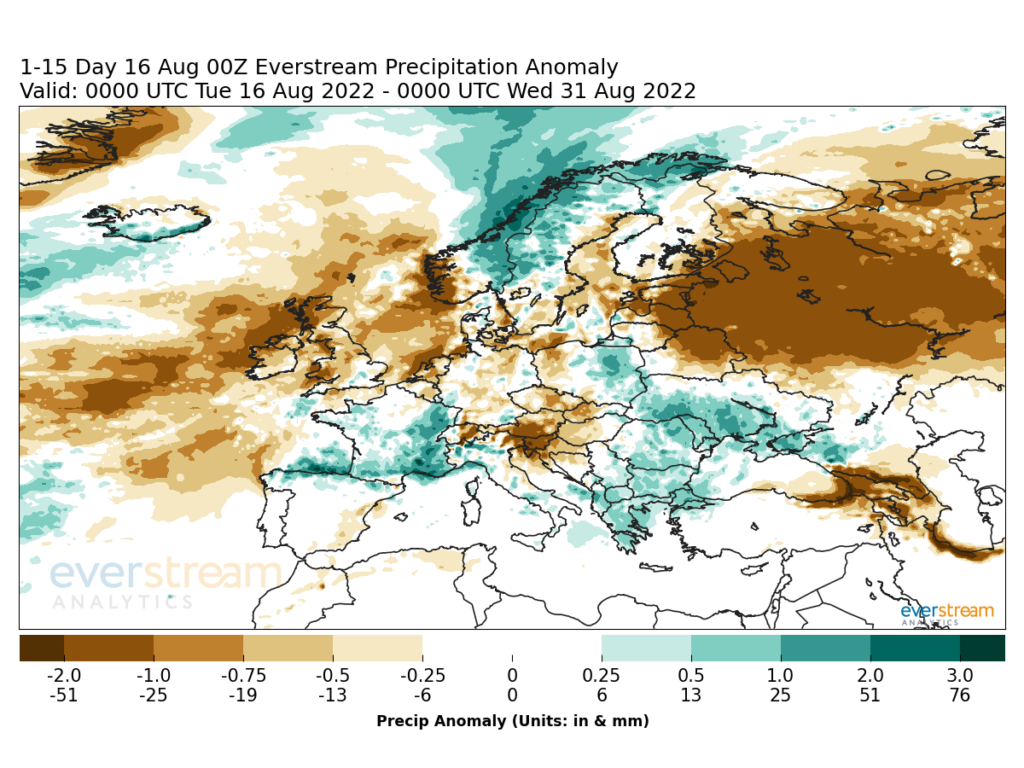

According to forecasts, low water levels are likely to persist. The Rhine River Basin will experience lower than normal rainfall during the remainder of July and into early August. While it’s possible that water levels may be high enough to continue normal shipping flows and manufacturing processes, any organization with exposure to low water levels on the Rhine River this summer should start thinking about a Plan B now.

Alternates to Rhine River routing

Without normal river capacity, the bulk of shipments will have to be re-routed through other avenues, such as air, rail, and truck transport. A rush to these methods may compound delays, as companies scramble to find capacity on these other methods of transport. For example, petrochemical, mineral, steelmaking, and agricultural companies all rely on river transportation to move products throughout Europe. And suppliers use the river to transport raw materials and components to manufacturers. If low water levels persist, there could be severe delays and reductions in raw materials and finished products.

BASF SE, one of the most influential chemical giants in the world, and ThyssenKrupp AG, a major steel firm, have stated that due to the changes in river traffic, their supply chains may be disrupted. This could lead to a decrease in production and an increase in cost for raw materials. This could have a ripple effect and push up prices of many goods, as these two companies produce chemicals that are used by many industries in producing their own goods.

The river’s low level has already had a negative impact on some of Europe’s biggest steel and chemicals companies. Companies such as BASF SE, Ineos Group, Solvay S.A., and ArcelorMittal S.A have declared force majeure on some of their products, due to a lack of cooling water from the river in 2018.

Without enough foresight and planning, the rush to air, rail, and truck could create delays in and of itself. An increase in demand and new bottlenecks could also raise prices for transport, disadvantaging businesses even more. And delays in river shipping could also affect alternate options, as jet fuel is often transported by barge to airports. Any potential reduction in jet fuel deliveries could present its own disruption that would need to be handled. Last year, for example, the Swiss strategic reserve Carbura released jet fuel from stocks to head off any shortages.

Switching delivery options takes time and planning. With Rhine River levels as low as they currently are, businesses should think about the next best transportation option for their goods to avoid getting caught in the mad dash to planes, trains, and trucks.

Historical Rhine River water levels are shrinking over time

This is not the first time in recent history that the Rhine River has faced low water levels.

From mid-April 2021, water levels of the Rhine River began to drop to critical levels, disrupting shipping operations on the stretch from Koblenz to Rotterdam. Later, in Summer 2021, the waterline level at Kaub dropped below the necessary amount for larger and heavier vessels to safely navigate the Rhine. The waterway remained open, but shippers were forced to run partially loaded vessels instead of maintaining normal shipping flows. Some logistics providers went as far as suspending their operations on the middle and upper Rhine.

Businesses also faced low water levels on the Rhine last year as well, disrupting a range of shipments and industries. The European energy crisis was greatly exacerbated by delays to coal shipments to power plants in Germany, and lower water levels also interrupted essential cooling processes at several nuclear power plants in France. BASF SE and ThyssenKrupp AG, large players in the chemicals and steel industries respectively, were forced to cut production.

This is becoming an ongoing trend. In 2018, several steel and chemicals manufacturers, including BASF SE, Ineos Group, Solvay S.A., and ArcelorMittal S.A. to declare force majeure on some of their products due to low water levels.

Surcharges based on current Rhine River water levels

During low water levels on the Rhine last year, shipping lines were forced to impose low-water surcharges on shipments. River dependent industries, including chemicals, metallurgy, and energy, were faced with increased costs.

There may be a return to low-water surcharges, as barge operators grapple with enforcing a safe level of cargo capacity. Companies relying on river transport have two options: either pay the surcharge, with price levels that fluctuate with the river levels, or quickly arrange alternate methods of transportation. Depending on their level of criticality and the amount of materials or product they need to ship, companies choose to pay the surcharges before abandoning river shipping for other transport.

Outlook and recommendations

Rhine River water levels likely won’t be leveling out any time soon. Companies should add Rhine River water levels to their supply chain forecasting to ensure they can make quick and effective changes to their shipping flows if necessary.

Since global river water level changes are becoming a persistent trend, organizations should also take long-term actions to ease the effects of water level fluctuations. Increasing storage capacity for critical raw materials on sites or having allocated space on other transportation methods may go a long way to preventing delays due to abrupt disruptions.

Lower water levels doesn’t necessarily have to lead to lowered shipping and higher costs with the right planning. Acting now will help mitigate low-water delays in your supply chain in the future.